If you are searching for a payment orchestration platform, it’s likely you currently:

-

Have a lot of different payment providers with different payout cycles, dashboards and reporting methods.

-

Find that reconciliation is getting increasingly complicated.

-

Don’t have enough staff to manage all the payment provider relationships.

Ideally, you’re looking for a payment orchestration platform that can manage your payment service provider relationships, unify all your application programming interfaces (APIs) and give you more control over the payment flow and customer experience. But what should you look for in a payment orchestration platform and how do you know which one fits your needs?

In this article, we’ll be looking at:

Looking for a payment orchestration platform to streamline your payment services? Reach out to us at Zai and we’ll let you know how we can help.

Top 5 payment orchestration platforms

There are multiple orchestration platforms that specialise in acting as a one-stop shop for online marketplaces and platforms and enabling access to specific financial solutions. However, some will only be available in certain countries, or will specialise in one solution and not another – for example, they may support multiple payment methods, but won’t be able to process cards or create bespoke solutions for complex payment flows.

For this reason, it’s important to understand what specific payment solutions you need before choosing your orchestration provider.

Here, we’ll compare five different payment orchestration platforms. Since we’re writing the article, we thought we’d start with ourselves:

1. Zai

We specialise in customised payment workflows via multiple payment methods, including NPP real-time payments, bank transfers, BPAY and credit cards in Australia. With 10+ years of experience, we provide a full suite of payment solutions that enable you to:

-

Receive PCI DSS-compliant Level 1 digital payments.

-

Accept global payments as well as instant Australian payment methods (e.g., PayTo).

-

Pay your end customers according to payment milestones.

-

Handle transaction routing and retries.

-

Make multi-party payments.

-

Manage fraud, compliance and risk.

With Zai’s payment orchestration platform, you can automate multiple aspects of the payment flow including the onboarding, the payment gateway for transactions made through debit cards and major credit cards (Visa, MastercardⓇ and American Express), wallet accounts, and then the collection and disbursement via direct debit, real-time bank transfers and alternative payment options through the NPP.

With Zai, you can manage the entire payment system, view specific payment data, and control the payment experience from start to finish. And, with our RESTful APIs, you can set the rules for each payment you receive so you can automate payment milestones, split payments or move payments to multiple parties to fit your specific business model.

You can also view and track your current and historical transactions, manage payments, and start refunds through your own custom-built dashboard. Or you can even integrate webhook notifications into your current tech stack to get instant and up-to-date alerts notifying you of payment events and status.

To give you a better idea of how Zai’s payment orchestration platform can work for you, let’s take an example of how we enable a proptech in Australia to control and automate its payment flow by relying on one payment provider rather than managing over five different relationships with different solutions.

How Zai’s payment orchestration works: A proptech example

Proptechs can be complex businesses, with multiple parties involved including:

-

Investors.

-

Contractors.

-

Insurance providers.

-

Tenants.

-

Financial services solutions.

Each provider will have different payment terms, due dates, and payment amounts, with these often changing regularly. As a proptech company, manually splitting each payment to the right provider and party slows down payments, causes human errors, and is very time-consuming.

With Zai’s RESTful APIs, proptech companies can set up a flow to make these payments automatic and seamless.

Here’s an example table of how a split payment goes through the process:

.png?width=610&height=189&name=Split%20payments_1@2x%20(1).png)

In this example, the property manager used an automated direct debit to pull £1,000 from the tenant and place it in that end customer's wallet account. Then, the split payments API goes to work, splitting the rent payment and crediting it across multiple end customers.

Since Zai offers multiple payin and payout methods, as well as custom payment workflows, the proptech company has control over the entire payment flow and can allow tenants to pay in their preferred payment method.

This approach is great for complex payment issues with multiple parties involved. With the right payment provider, the proptech's entire business model and payment strategy can be rethought and optimised.

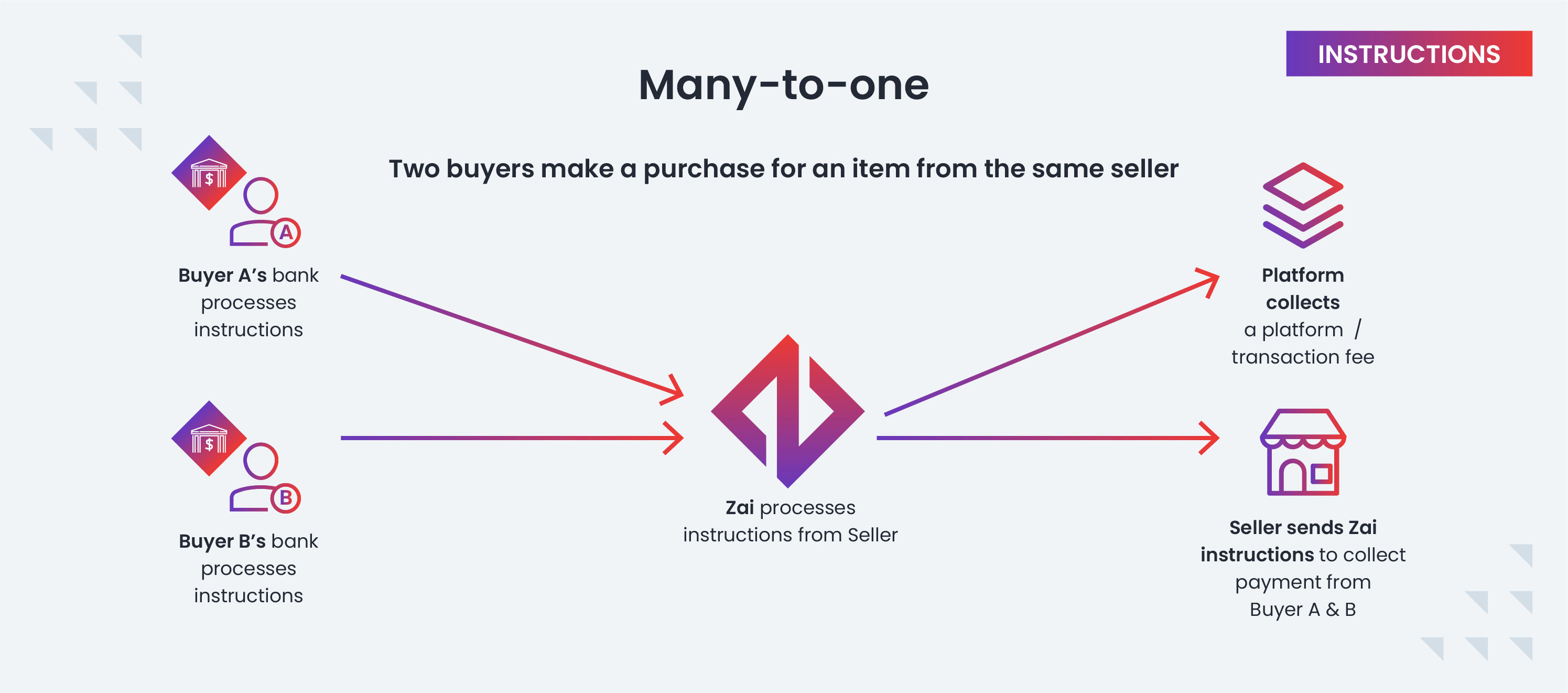

.png?width=2991&name=many-to-one_1%20(1).png)

Curious to learn more? Check out the Zai docs, including workflow examples and wallet accounts to see more of how this works in practice.

Who is Zai good for?

Many industries can benefit from Zai’s payment orchestration solution, including online exchanges, B2B suppliers, and marketplaces with a complex payment infrastructure.

Zai is great for companies that have complex workflows and multiple relationships with payment service providers (PSPs) that could be streamlined. At Zai, we service B2B, B2B2B and B2B2C and work across all verticals and company sizes, including startups, scale-ups and larger companies that want to go global.

Depending on your specific needs, however, it’s possible that Zai isn’t a good fit, and that other platforms may suit your business model better. Here are a few options:

2. Paydock

Like Zai, Paydock provides access to multiple solutions through an initial and single API connection. They connect to approximately 150 payment service providers globally.

Features:

-

Multiple payment methods.

-

Fraud prevention.

-

Payment gateway.

-

Payment routing.

-

PCI-DSS Level 1 compliance.

-

Recurring payments.

-

Data reporting.

They specialise in the following industries:

-

Banks.

-

Non profit.

-

Large merchants and retailers.

Who is Paydock good for? Any e-commerce that is looking to scale their online sales globally.

3. Corefy

Corefy is a payment orchestration platform connecting you to PSPs and acquirers globally. It specialises in payment processing, collecting payins and sending payouts globally for websites and apps.

Features:

-

Connections with 650+ payment providers.

-

400+ payment mediums.

-

Compliance measures and security.

-

200+ currencies.

-

White labeling available.

Corefy caters to these verticals:

-

E-commerce.

-

Gambling and betting.

-

Online gaming.

-

Dating.

-

Exchange platforms.

-

Payment providers.

-

Payment acquirers.

Who is Corefy good for? Online platforms with a global reach and high-volume payins and payouts.

4. Stripe Connect

Stripe Connect is Stripe's payment orchestration arm. It can facilitate payments, provide KYC onboarding and offer multiple payment methods.

Features:

-

Supports 135+ currencies.

-

Global payment methods.

-

Point-of-sale (POS) terminal solution.

-

Payins and payouts.

-

Global transaction routing.

-

Fast integration.

-

Fraud management.

-

PCI DSS Level 1.

-

PSD2 Strong Customer Authentication (SCA).

Stripe specialises in:

-

E-commerce.

-

Marketplaces.

-

SaaS.

-

On-demand.

-

Crowdfunding.

Who is Stripe Connect good for? Online marketplaces and platforms in the process of global business expansion with simple payment flows or with in-house technical teams that can customise their own solutions.

5. Adyen

Adyen is an Australian payment orchestration provider that operates globally. It provides a one-stop payment shop for online and offline transactions.

Features:

-

130+ currencies.

-

Online, mobile and POS transactions.

-

Global payment methods.

-

Payins and payouts.

-

100+ e-commerce, POS, and subscription service integrations.

-

PSD2 SCA and PCI compliance.

-

Risk management.

Adyen caters to:

-

SaaS.

-

Marketplaces.

-

On-demand businesses.

Who is Adyen good for? Adyen specialises in helping businesses that need global solutions.

What can a payment orchestration platform do for you?

We like to use the analogy of the shopping shelf and supermarket to explain how payment orchestration is and how payment orchestration works within your payment stack.

What is payment orchestration?

Payment orchestration is the handling of a variety of PSPs, from merchant account providers, payment gateway solutions and buy now, pay later (BNPL) options to acquirers, banking, and fraud protection providers, in one unified solution.

It’s like using a supermarket and choosing various items there that can help you design your ideal payment flow to ensure your end customers have a seamless payment journey.

How does payment orchestration work?

Usually, a company has to have multiple relationships with payment service providers, and possibly with hundreds of banks or payment processing companies. Each provider will have different reporting cycles, payout cycles, invoice terms and different dashboards, which can make it difficult to manage and maintain control over the payment flow.

For example, companies like Uber and Deliveroo will have over 100 payment service contracts across multiple countries, with various payin and payout methods and split payments – often with just a handful of people managing all those vendors.

Now, imagine if a company like Deliveroo only had one payment provider that acted as a supermarket. Instead of having to set up a new relationship with a new payment processor for each new payment method or new country, the company would simply ask their partner platform to support them with their new needs, and the platform would allow them to “plug in” to whatever has already been set up.

Some of the payment solutions the payment orchestration provider would help with includes:

-

Merchant accounts.

-

Acquirers.

-

Payment gateways.

-

Fraud detection and risk management services.

-

Alternative Payment Methods (APM).

-

Blockchain payments and more!

A payment orchestration platform unifies all those payment APIs and gives the company the flexibility to validate PSPs. Whatever payment technology your company needs to operate, the platform should be able to offer it.

The benefits of payment orchestration

Payment orchestration means you can have more control over the payment flow, including the ownership and authority to manage online payments the way you want to. Essentially, the payment orchestration platform acts as a one-stop shop for everything you may need.

These are just some of the benefits of payment orchestration:

-

Reduce payment processing fees: with just one provider managing most payments, there are fewer middlemen and therefore fewer fees.

-

Set up new payment methods in new markets: with one API integration, you can set up the latest payment methods that are popular in the new country.

-

Establish pre-built anti-fraud services: with one provider, you won’t have to set up different integrations for each provider. Instead, you’ll be able to use pre-built fraud configurations to test and find the best one for your company.

-

Improve visibility over your transactions: by using a platform that includes various payment solutions, as well as accounting services, you’ll be able to set up specific rules and events that will give you better visibility over movement. It helps reduce time spent on reconciliation and helps streamline the accounting process.

When is it a good time to start looking for a payment orchestration platform?

When you’re managing more payment service providers than you can handle and are having to hire additional team members to manage them - possibly over a hundred, with different dashboards and payout cycles.

What to consider when picking a payment orchestration platform

Make sure you know who their partners are

Some payment orchestration companies claim to do all types of orchestration – but they won’t reveal the names of their partners. This is often because they are using a just-in-time methodology and will essentially build the solution only once there is a customer that orders it. In essence, they use implementation money to build partnerships.

If your request is simple and basic, this solution is likely to be sufficient. But if you are looking for support operating a more complicated workflow, you’ll want to make sure that delivery and execution have tried and tested partners of the highest quality.

Do they work with your company size?

Some payment platforms will only work with large corporations.

It’s best to take a look at a company’s case studies and make enquiries about the size of the companies they commonly work with before deciding on which payment orchestration provider is best for you.

Orchestrate your payments with Zai

We hope this summary clarifies what a payment orchestration platform does, how it operates, and what to look out for when searching for a partner. If you think Zai might be a good fit, reach out to us today to find out more!

This information has been updated and is correct as of February 2023. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment. This article is purely for general information purposes.

Sources:

https://corefy.com/en-gb/about-us

https://paydock.com/

https://stripe.com/en-au/connect/features

https://www.adyen.com/