If you're looking for a set-and-forget way of collecting repeat payments for your business, there's a good chance a recurring billing integration has what you need. This tool is popular with many Australian tech and consumer companies since it lets them:

-

Build a completely seamless end-customer experience where customers can continuously pay for services or products without worry.

-

Offer additional payment options to improve cash flow and give customers more choices when it comes to how they move their money to you.

-

Easily implement and control an important part of their payment process.

-

Be compliant and adhere to regulatory rules in sectors with restrictions around payment cards.

-

Reduce payment failures, optimise reconciliation, and increase margins.

We wrote this article to help you choose the best recurring billing integration and payments provider for your company. In it, we cover:

-

When it makes sense to set up a recurring billing integration.

-

Which payment method to use for recurring billing and why add PayTo.

-

How Zai helps growing Australian tech companies with recurring billing integration.

Ready to explore recurring billing solutions for your company? We’ve been helping Australian businesses like yours create amazing direct debit and other payment infrastructure for over a decade. Contact us now to get started.

When does it make sense to use recurring billing integrations?

Recurring billing integration works in various industries and use cases. This tool is at its most powerful in the following scenarios.

If you have a subscription-based business model or known future recurring revenue streams

Recurring billing integration is an excellent fit for either subscription business models or where there's a known recurring revenue stream. These industries generally use this payment model the most:

-

Proptech and real estate management platforms, where a fixed rental amount needs to be collected during a set duration and on a predetermined day.

-

Utility companies that process customers’ bill payments regularly, but where the amounts can vary from one statement to the next.

-

Trade exchanges where investors are periodically adding funds to their investment accounts to execute their strategies.

-

Businesses that charge monthly or annual membership fees, such as gyms and wellness centres.

-

Online services charging a regular access fee on their customer portals like e-commerce, e-learning platforms and other SaaS tools that work on a recurring revenue model and base their revenue on subscription management.

-

Usage-based billing or metered billing models found in SaaS tools where end customers make online payments only for the amount of the service used.

-

Debt collection services and lenders that need to pull a certain amount of money from a debtor’s account each month to cover an obligation.

If you charge monthly or yearly recurring fees

Businesses that charge monthly recurring fees, such as gyms and online service platforms, are huge beneficiaries of recurring billing integration. It enables you to configure a “set it and forget it” end-customer experience and adds to your value proposition.

If you’re using fixed subscription billing software to generate revenue, you’ll want to make it as effortless as possible to get money from your end customers’ bank accounts, while avoiding fees and reducing failures in the billing process. The end-customer experience on your billing platform is also significant as it’s often the first interaction a new customer will have with you.

If you offer high-value transactions or have low margins where card payments aren’t optimal

In 2021, 20% of regular online shoppers preferred to use instalment payments when purchasing expensive consumer electronics and computing devices. However, companies that sell high-ticket items often see credit card fees take a significant chunk of their margin when they offer a buy now, pay later (BNPL) option.

Recurring billing through direct debit, credit cards or PayTo provides companies in these spaces with a way to protect margins and lower fees.

If your sector has strict rules or regulations on payments

In some industries, regulators limit the channels firms can collect payments from. For example:

-

Proptech. Tenants in Australia cannot pay rent with credit or debit cards due to reversal and credit concerns.

-

Investment apps that enable retail investors to buy and sell a wide range of speculative financial assets, including stocks and cryptocurrencies. Due to the inherent risk involved for brokers and intermediaries, end customers cannot use credit cards to top up their trading accounts. Instead, they must fund their activities using a bank transfer. Many investors like to dollar-cost average by purchasing assets or currencies on a fixed schedule.

A recurring billing model can help both of these industries make paying rent and building long-term wealth a more compliant and streamlined process.

If you’re looking to add another payment medium for your business

End-customer experience can be the differentiator between leading your market and trying to keep up. The best firms in industries like marketplaces and remittance use recurring billing to make it easy for their customers to pay them.

If your business model has your end customers paying you regularly, offering recurring billing solutions could be the difference maker you’ve been looking for.

Which payment method to use with recurring billing integration (and why use PayTo)

Traditional recurring billing methods can have benefits and drawbacks. To help you understand how PayTo is revolutionising bank transfers, we examine credit cards and direct debit for recurring billing and why it makes sense to start offering PayTo as an additional recurring payment method.

The pros and cons of recurring credit card payments

Pros:

-

Customers prefer cards for convenience, comfort and UX. Your customers can quickly enter the details from a physical card they have on hand and feel comfortable with this process because they know it well and trust it. If you only offer recurring traditional direct debits (not PayTo), customers will have to search for their banking details instead, slowing down the process. Cards also make online subscription renewals much easier and increase customer retention.

-

Payment failures due to insufficient funds or incorrect details are cheaper for the platform when they happen via card. While customers don’t pay for failures with fees, it’s certainly an embarrassing experience to receive a failed payment notification. Having to correct a payment failure with a card is as simple as entering a different one and helps to reduce churn when billing problems arise.

Cons:

-

Card payments come with fixed and variable fees, with the latter a percentage of the amount charged. For businesses that offer higher-ticket services, that percentage can hit margins particularly hard. When you use cards for recurring billing, that additional fee will ripple through your finances.

-

Card payments open you up to risk and fraud. You’ll need to have adequate systems in place to avoid and manage credit card fraud and chargebacks.

The pros and cons of recurring direct debits

Pros:

-

Low, fixed fees simplify budgeting and add certainty to forecasting. Direct debits use a fixed fee, eliminating the variable fee of cards and enabling merchants to know exactly what they’ll pay each month to collect recurring payments.

-

Easy-to-control mandates make setup, modification, and cancellation (almost) straightforward. Both the platform and their end customer can quickly control direct debit recurring billing themselves. In Australia, customers just need to provide their Bank State Branch (BSB) number and agree on the time, amount, and frequency of the direct debit. Merchants can quickly modify this information based on changes to the contract or terms and conditions agreed between the two parties. To cancel a recurring payment, the end customer just contacts their bank. However, there's often a couple of days’ delay in this process.

-

Set and forget with simple rules. Creating a recurring payment with a direct debit integration is a one-off affair once you’ve signed the agreement with your customer and input the parameters. You’ll need to have a recurring billing model built on your system to then automate the debiting and crediting of funds, with only the reconciliation process left for your accounts receivable to attend to.

Cons:

-

Direct debits make little sense for low-value transactions. Direct debits use fixed fees for pulling funds from a customer’s account and crediting it to a platform or merchant. Below a certain threshold, those fees either take too much of a margin or erase it altogether.

-

Variable pricing models are also a poor fit for recurring direct debits since small fixed fees can have outsized impacts on margins.

-

Higher fees for failures than with card-based direct debits. In theory, payment failures shouldn't happen because the parameters are set up in advance. In reality, that’s not always the case. And when a direct debit fails, the merchant pays a hefty penalty.

-

Some integrations can limit your flexibility. Not all direct debit providers in Australia work in the same way. Some payment orchestration platforms focus more on a front-to-back solution, which is relatively easy to implement but lacks customisation and full control. In these cases, modifying a direct debit can be cumbersome for both you and your customers.

-

Direct debit failures weigh heavily on your UX. A direct debit failure means double-checking bank account information, which is a negative experience for the end customer.

Why PayTo is a game changer for recurring billing integration

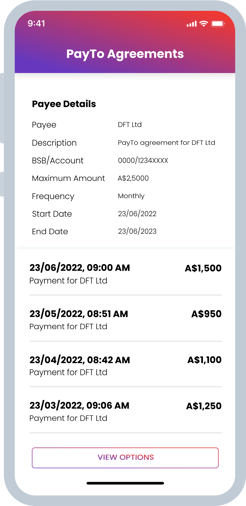

An initiative from the New Payments Platform (NPP), PayTo is bringing cutting-edge direct debit infrastructure to Australian businesses.

PayTo promises to improve two major shortcomings of the current recurring direct debit system by:

-

Streamlining direct debits by reducing the steps and friction involved in creating a recurring payment.

-

Making payments more instantaneous via the NPP’s real-time settlement engine.

While reconciliation teams and finance departments will no doubt prefer the second point, the first one is what has us excited.

Up until now, setting up a direct debit in Australia has been cumbersome for the end customer. As mentioned above, customers would need to find their BSB number and then provide it to the merchant, who would then need to manually enter all of this information.

Managing the direct debit was also difficult, as the customer would need to liaise with the merchant to make modifications.

With PayTo, set-up and control move directly into the customer’s banking app or dashboard. To authorise, the end customer only needs to validate the mandate with PayID, which authenticates the account details instantly. To make accessing and managing the parameters easier, the mandate sits in a common depositary. PayTo also works natively via API, which means it's great for tech-driven businesses here in Australia that need to use recurring billing.

We recently wrote about PayTo and how you can prepare for it. Feel free to check it out to learn more about this welcome new development. We’re such fans of PayTo here at Zai, that we’re one of the launch users in Australia.

Get in touch with us if you'd like to know how you can add PayTo to your payment stack seamlessly.

How Zai enables you to implement recurring billing within your scheduling

We’ve been helping local platforms and merchants create recurring payment solutions for over 10 years in Australia. Here’s how we enable firms like yours to incorporate this functionality into your payments infrastructure.

Our APIs connect your carefully crafted UI to our payment solutions

We’re an API-first payments provider made for tech-minded companies. With our singular connection point, you can access our direct debit and PayTo APIs that enable you to leverage our payment tech without disrupting your front end. That way, you can add our payment API to the scheduling and UI that your product department has spent hours perfecting without sacrificing look, feel or functionality.

When it comes to setting up a recurring fixed payment, all you need to do is ensure your front end is sending the required information to our PayTo API, which then connects directly to the NPP’s network. If you prefer using cards for recurring billing, we can handle that through our APIs as well.

You’ll have the flexibility to own the customer experience the way you see fit

We’re committed to helping you integrate recurring payments around your needs and not the other way around, which is why we like to think of ourselves as your payments back end. Our payment API connects to your scheduling to enable you to process recurring payments, so we can help improve customer experience and aid in retention. In turn, we can:

-

Reduce recurring payment failures (and the penalties associated with them).

-

Minimise declines and bounced payments.

-

Boost your brand loyalty and end customer experience.

Our webhooks are constantly listening so that we can pick up immediately any changes you or your end customers make when they happen. For a PayTo payment, that means amazing new flexibility.

Suppose you pull funds from your customer subscriptions on the first Monday of every month at lunchtime. At 11:00 am, one of your customers contacts you in a panic, saying they have an emergency and need the funds urgently.

With our tools, you can modify this person’s payment to later in the week in your billing system, and we’ll immediately pick it up. At noon, we’ll execute the pull from your end customers’ accounts or cards but will have already excluded your customer who needed a bit of compassion. If you’re using PayTo, then those funds will enter your bank account almost instantly thanks to NPP’s real-time settlement.

We’re more than just a direct debit provider – we’re a complete payment solution

At Zai, we’re payment experts. We can offer you a wide range of payment tools, including direct debits, card payments and BPAY, as well as being one of the first PayTo providers in Australia.

We’re a complete payment orchestration platform with tools for tech-first companies that go much further than just payment processors, payment collection and payment gateways.

As a PCI-compliant payments provider, we’re authorised to collect valuable card transaction data that enables you to better understand your customers. We have robust fraud detection tools that keep your end customers safe from the beginning to the end of their payments journey. We can also help you create wallets, which (when combined with payment orchestration) enable you to automate transfers right after you collect a recurring payment.

We build bespoke payment orchestration for your recurring billing needs

Our tech and product teams pride themselves on solving complex payment problems. That’s why we prioritise using all of our tools and expertise to orchestrate payment workflows built specifically for your needs.

For example, a proptech platform might help apartment management companies take rent from tenants and pay funds onward to various parties. Using a PayTo direct debit, the firm can immediately set up a recurring pull from the tenant’s bank account for the monthly rent.

Once the pull takes place, our tools can immediately split the payment and re-route the funds into separate wallets that go to multiple parties in the value chain, including landlords, maintenance companies, tradies, and others.

Since we can automate these steps from start to finish, the platform can spend considerably less time on reconciliation and focus more on end-customer experience. The possibilities are nearly endless, and we’re always ready to take a deep dive into your needs to find a solution that best works for you.

Why your platform’s success starts with the right recurring billing solution

Getting funds smoothly into your platform is key to your business' recurring revenue model. Direct debit, PayTo, and card payments all offer companies a viable way to enable the collection of repeat payments. However, choosing the wrong recurring billing integration can hinder every aspect of your business, from your end-customer experience to your profitability.

Conversely, getting your recurring billing payment infrastructure right puts you in an excellent position to own your market through superior end-customer experience, minimal reconciliation, and a more robust bottom line. We’re ready to help you take the lead on your recurring billing business model. Contact us today to see how we can work together.