Although there are a lot of articles out there that cover how PayTo works and why it’s important, there’s a lack of information on how to prepare for PayTo and set you and your company up for success.

For that, you need to understand how PayTo impacts your business, what you can do now to prepare for it, and which use cases make the most sense for PayTo.

In this article, we tell you what you need to know to successfully plan and implement PayTo into your payment stack. We’ll cover:

(Excited about PayTo and want to get straight to the implementation? Speak with one of our payment experts to get set up right away.)

What Australian companies can do to prepare and plan for PayTo

If you’re not aware of what PayTo is and how it works, we recommend you read the following articles we’ve previously published:

Just to recap, PayTo could touch almost every aspect of your business, including your:

-

Tech stack.

-

UX and UI.

-

Liquidity and treasury management.

-

Product possibilities.

-

Obligations facing your client.

We sat down with our payments experts here at Zai, and here’s what they suggest firms can do to ensure they’re ready for PayTo.

Coordinate with your finance team so you have a cash management plan in place

Unlike the current legacy direct debit system that settles payments in overnight batches one to three days after payment, PayTo credits your account instantly.

In other words, your finance department will see a significant increase in intra-day balance movements on your account.

Having more instant liquidity could be a gamechanger for your business, particularly on how your treasury department handles cash management.

For this reason, it’s important to coordinate with your finance team to ensure they're aware of the increased liquidity, and have time to plan for managing a real-time payment environment.

Know which data fields will impact your payment infrastructure

One of PayTo’s biggest selling points is that it will open up brand new possibilities for payments by adding more variables and features. For example, as a business, you’ll be able to check that funds are available before payment is taken from customers’ bank accounts, or add dynamic real-time recurring payments.

For that to work, NPP (New Payments Platform) has adjusted and created new fields for sending and receiving information, both client-facing on the UI side and to your payment provider.

Mandatory PayTo Fields for your customers

These are the mandatory fields you need to present to your customers and have them complete for the NPP to accept them for PayTo:

-

Payee account (i.e. your business).

-

Description of the payment and its purpose.

-

The amount.

-

Frequency.

-

Linked account of the payor’s choosing.

-

Start date.

-

End date (unless the payment is ad hoc).

-

First payment.

Mandatory fields you’ll need to fill in as the payee or creditor:

As the payment recipient, the NPP requires you to provide the following information in your PayTo order:

-

The initiating party (your name or a 3rd party if it’s running through you).

-

Your BSB and Virtual Account Number.

-

Payment agreement type (authorised payment mandate or migrated by creditor mandate).

-

Not providing these fields creates fails, which can open you up to claims.

The reason behind these mandatory fields is that the NPP will act as the central mandates depository in Australia. That means any firm authorised to use this infrastructure will be able to upload a PayTo mandate request which, on the other end, will match with the payer data from any Australian bank.

Having these new fields in place - the data richness allows for ease of reconciliation; which will result in increased efficiency and productivity as your team doesn’t need to troubleshoot on the status of the payments. Depending on your business needs, you can also include additional fields. We cover all these fields and more in our docs, so please feel free to check them out for a more in-depth look at the technical side.

Work with your product team to redesign your payment workflow

Since PayTo offers a ‘clean slate’ to payments, it’s crucial that you look at each level of your UX and UI where payment flow touches your business.

For one, you’ll probably need to rebuild your payment backend and, potentially, user interfaces from scratch. That might mean going back into an end-customer testing and iteration stage (more on that below) before going live. However, integrating with a single integrated API will allow for a much more seamless integration into the PayTo solution.

Of course, the upside is that these periodic revisits are probably happening already, so combining PayTo implementation with a product review would help set you up for success.

For example, if you’re running a marketplace or an exchange platform, PayTo will impact how fast your end customers can pay each other or, for investment exchanges, how quickly funds can get on the market. You should ensure that your UX, UI and even marketing reflect these changes.

Set up new communication and agreement processes

Part of PayTo’s mission is to give payors greater visibility and more control over their payments, including:

-

Payers/Debtors have five calendar days to approve a PayTo agreement.

-

If they don’t approve it within this time frame, it expires, which needs reauthorisation.

These approval rules offer a chance to improve customer experience since PayTo goes in real-time rather than in batches. But it also means you’ll need to incorporate these changes into your communication with end customers.

For example, trading platforms want their customers to get funds on the market as quickly as possible. Before PayTo, if an end customer set up a direct debit payment incorrectly, they would only know about it one to three days later. With PayTo, they have instant feedback through alert notifications and can fix any errors immediately, enabling them to start trading directly and not down the road. It’s important end customers are aware of those changes and can agree to them quickly.

Understand your obligations under the PayTo mandate

To ensure that PayTo works as intended, the NPP set out some obligations that customers must follow. For example, requiring payers to approve a PayTo agreement within five days, after which, you’ll need to reauthorise the mandate.

PayTo agreements are only obligations for executing the payment and not the underlying service. That means if your end customer cancels their PayTo mandate, they’re still liable for their part of the contractual obligation between you.

Likewise, your PayTo payment initiation must be compliant with the new system’s rules for it to be valid.

Failure to follow NPP guidelines could get you removed from the payment system. You would also be potentially liable for claims, including the failed payment and associated costs.

Take the time to test and plan before launching PayTo

With PayTo, you’ll have considerably more flexibility with payments - be they recurring, ad hoc or one-off - than with the current system. In fact, with PayTo, the new product combinations are nearly infinite.

You can have a loose, open mandate allowing for payments on numerous conditions and for board mandates. For instance, you can set up recurring payments that start and stop at specific dates, and change payment amounts on a monthly basis. Likewise, you can play it tight and simple and use PayTo for one-off or ad hoc monthly payments.

Whatever you do, testing your PayTo builds is critical to ensuring you don’t run afoul of the system. You’ll want to set up end-customer tests and product tests in sandboxes or staging environments, to ensure you set up a secure payment flow that is compliant and is aligned with your business model.

It’s important to note that the more complex your payments (e.g. if you use algorithms to set prices for various items), the more sophisticated your compliance procedures will have to be.

Since we are in the very early days of PayTo, now is a good time to test and make mistakes, as customers will be more forgiving. In one year, customers will have certain expectations which could make it harder to test a particular UX and setup.

Top PayTo use cases

Here are some of the use cases for which PayTo would bring immediate benefit:

Companies that want faster payments and less market exposure

Under the current system, a direct debit takes one to three days to clear. However, even a few hours of delays are massively consequential if, for example, you need to convert currency and send it onward or fund your market account.

For example, remittance companies that offer FX exchange often have to go out to the currency market and enter into short-term forward contracts. These hedges are meant to cover market exposure between when the payer’s debited funds hit your market account and when you can execute the conversion.

With PayTo, the funds can enter your market account and immediately go out for exchange at (close to) the market rate. PayTo vastly shortens the entire remittance process, reducing market exposure and, more crucially, getting the funds to the people who need them.

Trading, investing and banking apps and other financial services companies are in a similar situation. For end customers on these platforms, their objective is to trade when they see an opportunity. As stocks and cryptocurrencies trade almost around the clock, being able to fund your account and execute your strategy immediately is a huge benefit of PayTo.

Companies that are trying to reduce their reliance on costly credit cards

Payment cards are a double-edged sword. On the one hand, your end customers love them because they’re convenient and have some layer of security. On the other hand, your business has to pay a hefty premium to accept them.

Direct debits in their current form offer an alternative cheaper solution, but they take up to three days to settle and aren’t convenient for the customer.

PayTo brings together the benefits of both the credit card and direct debit, but offers instant settlement and is a lot cheaper than credit cards.

It’s also worth noting that PayTo’s centralised mandate depository also improves the customer experience by making it easier for payers to validate a new payment with PayID. This convenient method reduces a lot of the friction associated with the older direct debit system, making the PayTo experience closer to that of a credit card for your end customer.

Other use cases

There are many more specific use cases for PayTo, for example:

-

Property technology (proptech) companies that want to collect payments in a faster, more reliable way.

-

Streamline payments for payroll and accounts payable.

How Zai will help you implement and succeed with PayTo

We’ll set up performance testing before you roll out PayTo

We aim to ensure PayTo improves your business, brand, and market share, not harm it.

Based on our 10+ years of experience working with split payments and custom payment flows, we can help all new and existing Zai customers during the testing phase to ensure PayTo enters production smoothly.

That way, we help ensure you remain compliant, keep costs low, and are set up for success with PayTo.

We handle NPP validation and reconciliation automatically

We can validate a payment or an end customer automatically by checking with the NPP that the agreement exists just before executing your payment. If it does, we will directly credit your wallet or account with us and notify you immediately afterwards.

If the payment fails or the agreement isn’t valid, we’ll return it automatically to the payer’s bank. That way, we help you prevent failures and claims that can lead to ejection from PayTo.

We send you the right notifications

The downside to having instant real-time payments is that cash can flow into your account anytime, making it hard to keep track of transactions.

To help make staying on top of real-time payments a snap, we’re rolling out numerous reporting and notification tools for you to incorporate.

We can help you leverage other payment tools

PayTo might be the new ubiquitous payment standard in Australia, but what counts is how you manage those funds once you receive them.

At Zai, we specialise in setting up custom and automated payment flows and helping you design a payments infrastructure that fits your business model. Here are a couple of the payment tools we can help you set up:

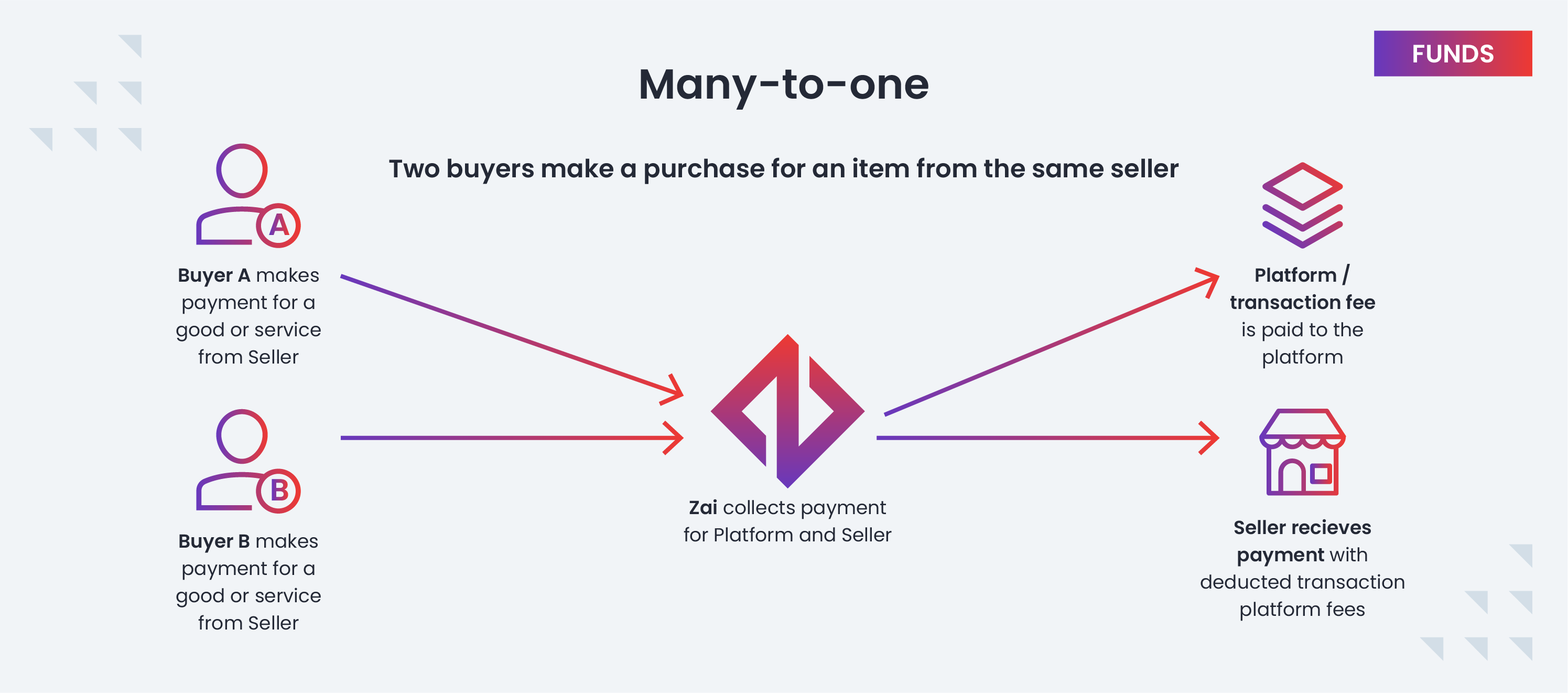

Multiple custom payments flows and split payments.

Some of the most powerful features are split and multi-party payments.

With multi-party payments, you can set up payment flows that automatically credit and debit various end customers. With a split payment API, you can set up as many flows as needed to split the payment amount.

For example, trading apps can use split payments to split the pay-in received from end customers and automatically credit the trading account and bank account, route funds to third-party partners and collect their fees.

Have access to the right licences

At Zai, we have banking partners, which means we have the right licences to support payments and certain features. For example, we hold an AFS licence which our customers can use as a Corporate Authority Representative.

Set up integrations with multiple payment methods

We work with popular marketplaces and platforms across a wide range of sectors to offer our payment services to their end customers. That way, businesses using popular customer, inventory, and marketplace systems can add our payment products easily to their digital storefronts.

We also accept a wide range of payment options, including traditional direct debit, BPAY, and credit cards.

We’ll be your partner for PayTo

For any Australian company that's payment-heavy, PayTo is going to be game-changing. Like any innovative disruption, though, the winners in the space will be those who adopt early.

For competitive industries with recurring payments like trading platforms, remittance services, proptech and more, getting on top of PayTo now will give you a true competitive advantage.

Speak with a Zai payment expert about how we can help you put PayTo into your company’s payment stack and keep you ahead of the curve.