Are you looking for a payment API to enhance your customer purchase experience? If so, you’ve likely hit the limits of out-of-the-box payment solutions. These barriers often include:

-

The inability to process payments in real time, preventing a streamlined checkout experience and purchase journey.

-

A lack of up-to-date payment data, which slows down the movement of funds.

-

Moving funds through a complex payment flow requires too many manual tasks, which keeps you from creating the ideal customer experience you envision.

The right API-driven payment stack can not only solve these problems but also open up an exciting new level of payment possibilities. We’ll explain how our APIs work and the benefits of using Zai for custom payment solutions, including:

Ready to learn more about how we can help your company better master your payment API needs? Check out our docs or speak with one of our experts today.

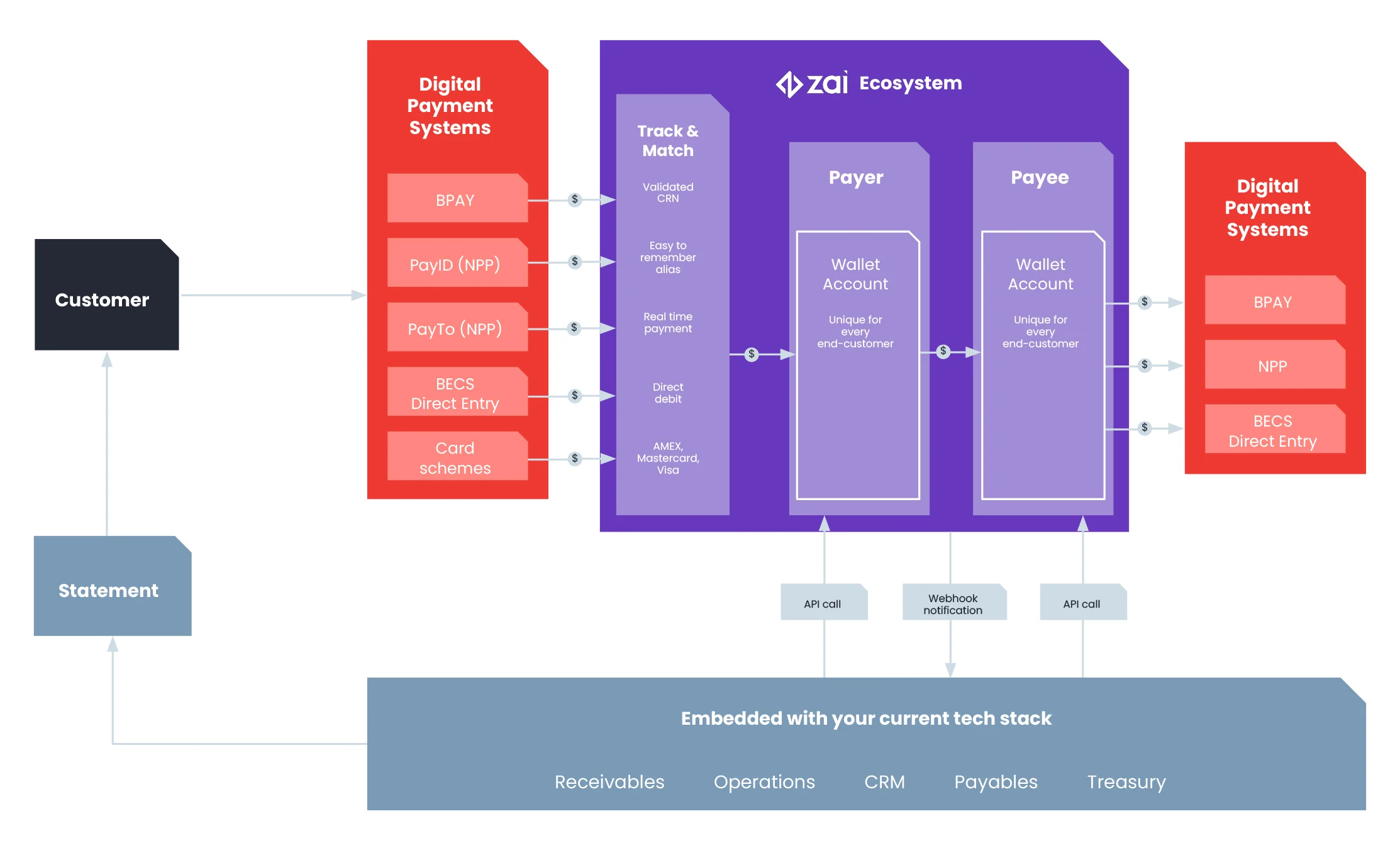

How Zai’s payment API works

We’re a tech-first payment orchestration company that always has the CTO and CPO in mind. For over a decade, we’ve been creating bespoke payment solutions for growing online platforms’ complex payment challenges.

You can integrate easily with Zai through a single RESTful application programming interface (API) connection to tap into a full suite of payment technology. Not only will you have a variety of payment methods to choose from, but with Zai’s API-powered solutions you can also access:

-

Automatic payment processing.

-

Automated payment flows.

-

Bespoke payment design.

-

Automatic reconciliation.

-

Always-on technology with 24/7 connection.

-

Technical documentation.

-

A developer sandbox to test out our payment technology.

-

Fraud prevention and protection.

-

PCI level 2 compliance for card payments.

-

Local Australian expertise and support.

Think of Zai as a payment partner who ensures comprehension of your needs from your first conversation with us. We know how to keep our payment solutions aligned with your evolving roadmap while offering you up-to-date technology and APIs.

Read on to learn more about how our APIs can help you create customised payment solutions for your business.

Why use Zai’s payment APIs?

With our full suite of payment solutions, we can help you design and implement your ideal customer payment experience. Here are just some advantages of working with Zai.

Add multiple payment methods easily

We operate as a payment service provider, which is how we ensure you can directly plug into many popular payment options, including:

-

Debit cards and credit cards (Visa, MastercardⓇ and American Express).

-

BPAY.

-

Direct debits and bank transfers.

-

Real-time payments through the NPP, including PayTo.

You can access these payment methods and more through Zai without having to integrate with multiple payment providers. By using one provider for all your payment needs, you can save time and your margins.

Learn more about our debit and credit card solutions in this video:

Offer customers the payment methods they want

Zai can satisfy many of your payment needs to match your customers’ payment preferences.

In addition to card payments and direct entry, you can give your customers access to local Australian payments with Zai.

For example, get real-time payments using NPP payment rails, offer one-off or recurring instant payments through PayTo, and set up dynamic multi-party payments using different methods for payment collection and disbursement.

The variety of payment options available can help ensure satisfied customers will return to your online platform or marketplace again and again.

Process payments through our gateways

With Zai, you won’t have to connect to separate payment gateways because we connect to them for you.

You’ll get automatic payment processing with a dedicated payment gateway API connection for the payment methods you choose. We’ll take care of the compliance and payment tokenization, too.

We can even process individual line transactions as they come through instead of compiling a report or ABA files that we send off to the merchant acquirer. This means quicker and more efficient payment processing for you with a ledger-like approach so you can easily see all your transactions at a granular level.

Automate complex workflows for faster payments and customised solutions

With Zai, you can get more than simple collection and disbursement. We can create bespoke payment designs to match your business model and execute your complex payment flows.

Our wallet accounts, payment-event rules and API webhook notifications are the nuts and bolts to automate your payment flows, no matter how complex they may be.

For example, you could use a payin from a customer to not only fund your own wallet account immediately but also, by using split payment logic, pay multiple parties instantly. You could also use this payment information to create new end-customer wallet accounts or exciting new applications, such as pooling individual transactions for a batch payment.

Our payment APIs are also on 24/7 so your customers can make a payment whenever they need to. Since we can provide this payment service to each one of your end-customers, their transaction enters the network of their choice almost immediately instead of at a certain time of day or week. If you choose to use a new medium like PayTo, they’ll be able to settle a bill instantly with their counterparty.

We also make reconciliation a breeze. Just add a virtual account (which has its own unique BSB and account number) to a wallet account so you can automatically and instantly match, track and reconcile incoming NPP and direct entry (DE) payments.

Real-time updates for enhanced communication

With our real-time APIs and webhooks, you don’t need to wait for hours or even days to move through the customer payment journey. Instead, you can immediately receive the feedback you need to tell your end-customers that their funds are safely with you ready for use.

As an example of real-time updates, take an online learning platform that offers courses on demand for a monthly subscription. The platform offers new customers a free first week on the platform as a marketing lead, requiring them only to input a bank account or a credit card number for later debit.

Seven days after a customer enters their card data, the platform initiates payment processing, but unfortunately, the payment details are incorrect. The platform prompts the customer to update their card information, which, thanks to Zai’s payment ecosystem, immediately validates the card and pushes a confirmation via a webhook to the platform.

Within seconds, the platform unlocks the customer’s account, keeping them engaged without interruption. To ensure there won’t be any issues later, Zai tokenizes the card details for future authentication. Now, not only will future subscription credit card payments go through interrupted, they’ll be more secure.

Get built-in fraud protection and compliance

Zai comes with built-in protection and compliance measures, such as:

-

Know your customer (KYC) screening and anti-money laundering (AML) checks for better, quicker customer onboarding.

-

24/7 monitoring of your payment workflows to detect and notify you of any hiccups, so you and your customers can transact without worry.

-

Dispute management so we can investigate before confirming chargebacks.

-

PCI compliance (level 2) with card schemes already built in so you can protect your end-customers’ data.

-

3DS2 customer verification and authentication (coming soon).

Receive custom support

We take a hands-on approach from the first time you reach out to us so you won’t have to struggle with a do-it-yourself model.

Our process works like this:

-

An introduction call.

-

A follow-up call between your tech or product leads and our technical experts. During this meeting, we want to make sure that our products align with your long-term payment needs.

-

We make an assessment and craft a proposal specific to your needs, including complex, multi-payment flows. During this time, you’ll have access to our sandbox, letting you test your ideas and get familiar with our tech.

-

You’ll then build and implement our payment APIs into your platform, helping you reach the customer experience envisioned by your CPO and CTO.

During this entire process, we work hand in hand with you. That way, we can ensure that our success is your success and vice versa.

How a growing B2B platform used Zai’s payments API to reinvent their industry

Ordermentum, a leading B2B online order management platform in Australia, had a problem: despite alleviating a major pain point in the food services industry, their limited payment capabilities were holding back their true potential and mission to help the hospitality industry trade smarter.

This platform aids hospitality providers to instantly connect with suppliers. That way, restaurants and hotels of all sizes can source the produce they need to prepare top-notch food and beverage. The problem, however, is that no two end-customers on their platform are alike.

Customers range from large restaurant chains all the way down to small cafes. Each one of these entities has different financial needs, credit lines, and business strategies. To fully meet these demands, the platform had to ensure that each end-customer would get an online payment experience fully in line with their financial capabilities. Conversely, the suppliers on their platform also needed to see payment confirmation quickly, considering many of the products they sell are both low margin and perishable.

Our payment APIs and our team of experts sat down with their tech and product leads to learn about their vision for the perfect payment flow on their platform. After the meeting, we got to work on building out a model schema using the payment API as its base.

The resulting work produced a proposed solution that enabled customers to set their payment parameters, and automate commissions and other payouts, while also incorporating instant notifications.

Now, thanks to Zai’s payment APIs and experts, the platform:

-

Lets buyers pay for products through whichever medium of their choosing.

-

Enables purchasers to set up direct debits and stored value accounts for recurring orders.

-

Uses webhooks to notify sellers the second a buyer makes a payment, even if the funds take hours or days to clear through the network.

-

Takes their commission directly through the platform via intelligent payment flow.

-

Builds trust between all parties.

-

Provides countless Australians with higher-quality meals.

The platform continues to change the way Australian hospitality companies source products from providers. As their customers’ payment needs grow, Zai will be right there to support them.

What to look for in a payment API?

The payment space is constantly evolving as new technologies arise to meet increasingly bespoke customer demands. Here are four aspects to look for when choosing a payment API.

1. The right support

Find a payment API provider that combines regular tech updates with frequent requests for feedback and an easy point of contact.

You want to make sure that the payment provider has your best interests in mind. This kind of commitment to your success could range from creating a product update to helping you adjust your schema to interact with their payments APIs more efficiently.

2. Continuous innovation to keep your payment offer up to date

Look for signs of payments innovation in an API.

For example, you may want to check if the payment API provider is adding new payment methods, like PayTo – the new real-time account-to-account payment method in Australia.

This way, when a new payment method rolls, you can request to access it directly from your current payment provider instead of having to find and connect with another provider.

The cost savings of having an already-incorporated API connection with one provider is already a benefit. However, having all your connections under one provider will simplify the tech, so your IT teams can add this new medium to your platform or website with minimal coding and minor adjustments.

3. Payment customisation to bring your vision to life

Look for the possibility of bespoke solutions to ensure the best payment experience for your customers.

Most off-the-shelf payment solutions have two constraints:

-

Many don’t place nice with your existing platform interface and customer experience (CX), sometimes forcing your end-customers to go off platform to complete a payment

-

They lack the true customisation that lets you deliver a fully personalised experience.

These limitations pose serious threats to customer experience, and, by extension, revenue.

Look for a payment provider that overcomes these shortcomings by operating exclusively in the back end. That way, you can incorporate payment solutions based on how you’ve designed them for your customers.

Here at Zai, as part of our commitment to customisation, we’re more than ready to offer your platform integrations to meet your interface requirements in a fully compliant manner.

4. Real-time payments and automation

Work with a provider that offers always-on technology and real-time payment methods.

Instant payments can make your customer experience seamless, as well as give you up-to-date notifications of payment events. This can be especially helpful when a payment fails, so you can automate an instant response to the customer who receives a payment request to emit their payment information again or choose a different method.

At Zai, our payment APIs are active 24/7, 365 days a year. This enables your end-customers to transact with one another in seconds and allows funds and goods and services to exchange contemporaneously, without delays or doubts.

Conquer your challenges with Zai’s APIs and experts

As a tech-minded product leader, delivering your vision of a perfect platform hinges on how smart, automated and effortless it is for your customers to make and receive payments. With Zai’s payment API, you can make those innovative goals a reality.

Our team of experts is up to the challenge of helping you with your payment goals, regardless of how complex they may be. Contact us today to get the conversation started.

This information is correct and updated as of July 2023. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes.