If you're in the proptech, online marketplace, fintech and remittance, or gig economy sectors and are growing your business, you're probably looking to automate multi-party payments. You may be dealing with:

-

The increasing complexity of payment collection and disbursement as your stakeholders grow.

-

The high costs of adopting additional payment service providers and hiring more developers to manage the complexity without forsaking your customers' payment experience.

-

Technical mistakes when you use multiple payment service providers with conflicting systems.

-

Costly human errors that come with manual payment splitting, accounting and reconciliation.

To help product managers and technical leads, we’ve written this article explaining how we can automate multi-party payments and how our successful clients use them to their advantage.

We'll look at:

-

How Zai helps you build a bespoke multi-payment infrastructure.

-

How a property management system uses Zai's APIs to manage multi-party payments.

-

When does it make sense to automate a multi-party payments solution?

-

3 questions to discover if multi-party payments are right for your business.

Are you ready to take your company’s multi-party payments infrastructure to the next level? Speak to us now to see how we can help you scale your payments and your business.

How Zai helps you build a bespoke multi-payment infrastructure

Here at Zai, we’ve been helping innovative companies build payment solutions for over a decade now. Here’s the process we use to help our clients successfully implement multi-party payments on their platforms.

1. We start by learning about your business needs

We first have a meeting with you and your technical leads to learn more about your business model and existing payment flow. This helps us understand your goals and how you approach your end customer's payment journey. It also enables us to comprehend your infrastructure, so we can propose a customised approach that can seamlessly embed into your tech stack, without having to rebuild it.

2. We then begin orchestrating the different parts of your payment flows

Making your payments work in harmony is key to successful automation. Based on our first talk, we set out to orchestrate your multi-party payments. To do so, we study:

-

The parties involved. Who gets paid, and which percentages should your end customers receive when another one of your end customers makes a payin?

-

The permissions. Do you want to set rights for who can execute payouts, whether it’s from the selling party or your platform itself?

-

Timing. When do payouts occur and how are they split?

3. We work with your tech team to optimise your interactions with our APIs

Once we’re comfortable that we understand your needs, we go to work with your tech team to help them implement Zai’s multi-party payments tool into your system. We dedicate a large amount of this work to ensuring that the payloads sent between us are as optimal as possible based on what you need within your tech ecosystem.

4. We support you through your journey

As long as you’re working with us, we’ll be there to support you as your business evolves. That way, you can ensure your multi-party transactions continue to operate as planned, both today and in the future.

Why automate multi-party payments with Zai?

There are lots of services out there proclaiming to offer multi-party payment solutions. Not all of them are created equally. Here’s why our customers choose Zai to power their payment infrastructure.

Use a lightweight but powerful integration to get started

Zai works as a single point of integration. You connect to our payments ecosystem through one lightweight and agile RESTful API. This means you'll have instant access to a full suite of payment APIs and tools with a reliable integration that's simple to use and can enable you to orchestrate your payments quickly and easily.

Get a full suite of innovative payment APIs ready for you to test

We know that your developers’ time is one of the most important resources in your company. To that end, we’ve made great efforts to write comprehensive documentation and API references so they can get to work building without confusion.

Once your engineers are ready to build your multi-party payments product, they can test out their code or even try new features inside our sandbox.

Work with payment solution experts with 10+ years of experience

Zai has been helping companies build great payment solutions for over a decade. During this time, we’ve helped our customers reach new levels of success that we’re proud to share.

Our payment orchestration experts ensure that you’re not running around trying to figure out how to use our tools. Instead, we use our expertise to help you make the most of Zai’s multi-party payment tools and APIs, from designing your ideal payment flow to guiding your use of our payment technology.

Implement automated multi-party payments easily

For tech companies, time runs a lot faster than in traditional industries. As a tech company ourselves, we’re well aware of what stakes are at hand when it comes to implementing a new product while the opportunity is still hot. We’ve designed our APIs to get your multi-payment solution up and running in days, not months.

Consolidate all your payment needs (including multi-party payments) in one provider

Over the years, we’ve built a wide range of payment products for our customers. These include:

-

Wallet accounts for each of your end customers. These accounts enable you and your customers to collect funds, instantly transact with each other, and disburse funds directly to external bank accounts. These funds can stay in customers' wallets for minutes, days, or even longer.

-

Unique PayIDs and virtual accounts. Assign a unique alias for each of your customer’s virtual accounts with a one-of-a-kind reference number and easy-to-remember email to aid and automate reconciliation. The use of unique PayIDs and virtual accounts can instantly provide your finance teams with the details of payments made via the New Payments Platform (NPP) and automatically sync data with your ERP and accounting software.

-

Simplified float management. When disbursements exceed collected funds or when you need to pre-fund a payout before a payin actually clears, you can apply Zai’s suite of APIs to manage a float. For example, if you need to pay 3 end-customers $100 every day for a week, you can load a float wallet account with $1,500 and automate the payouts as needed. You could even decide to automate a top-up to your float account when its balance drops to 2 days' worth of payout funds.

-

Integrations to improve your customer experience. You put a considerable amount of time into testing and optimising your checkout experience for customers. We understand how critical this part is to your success, which is why you can integrate multiple options via our payment APIs.

-

Compliance and fraud controls made for online marketplaces and platforms. Protecting your end customers while reducing fraud and chargebacks goes a long way toward building trust with your audience. Our platform automatically runs these checks on transactions, keeping your end customers safe while guarding your business.

-

Accept multiple payment methods. With Zai, you’ll be able to accept debit card and credit card payments, direct debit, BPAY, PayTo and NPP real-time payments, and a variety of alternative digital payment methods.

With our full-suite payment orchestration service, Zai can consolidate your separate payment needs into an all-in-one solution to help you reduce costs and complexity, while enhancing your end customers' overall experience.

How a property management system uses Zai's API to manage multi-party payments

Properties are complex businesses with multiple suppliers and obligations, including:

-

Investors and landlords.

-

Standard utility payments, such as lifts and hallway lighting.

-

Insurance.

-

Tradespeople and other service providers.

-

Any other financial services obligations, such as loan repayments.

Each of these providers has different payment terms, amounts, and due dates. Further, tenants come and go, with rents changing based on market conditions.

If you’re a proptech trying to split each amount and transfer it onward to multiple parties, you’ll often end up spending a lot of time calculating and executing payment requests.

If you've ever been in the manager's seat (or even spoken to those handling multiple payments), you know how quickly this process can become overwhelming.

With Zai’s API, this becomes automatic. Here's how:

-

Once you’re set up and live with Zai, you’ll be able to create a custom payment flow.

-

Within the flow, you can assign each entity a customer ID on both sides of the payment equation.

-

Then each of your end customers, including the tenant and all the suppliers, gets a unique wallet account.

-

Through Zai's API requests, you can set rules for how to split each payment event and pay multiple parties.

.png?width=2991&name=Split%20payments_1@2x%20(1).png)

-

Then, by the logic set in the system, the payments move both effortlessly and instantly between e-wallets to the respective parties.

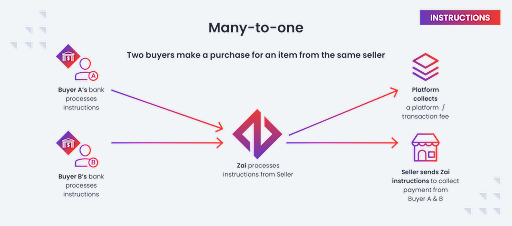

.png?width=2991&name=many-to-one_1%20(3).png)

For example, you can send a part of the money that's in the tenant's wallet to the landlord's wallet account and then push that to their bank account. You can also set up taking your commercial pricing fee at a certain payment event and at a certain date and time.

How Zai automates multi-party payments for proptechs

From the perspective of a property management system, the steps in Zai's multi-party payments function look like this:

-

Once onboarding is complete, you can automatically set up tenants, landlords, and other suppliers with a wallet account within Zai's payment platform.

-

The tenant uses a bank transfer, direct debit or another payment method to pay the rent, which goes into the tenant's wallet account.

-

Using the rules you set, the API can then divide up the amounts owed to each supplier and move those funds into their respective wallets. So here, the landlord would get their net rent payment, the property management company its commission, and the remaining utility and handy bills credited.

-

Depending on who needs payment and when, the API will transfer the funds to the respective bank accounts. As Zai connects directly to multiple payment clearing systems, these transfers settle in one to three days.

You’ll just need to set the rules for each multi-party payment split, which you can do via our APIs.

Of course, the real estate rental sector isn't the only one to benefit from Zai's split payments API. We've seen use cases in online marketplaces, platforms and exchanges. Even B2B suppliers in the fast-moving consumer goods space apply our tools to great success.

When does it make sense to automate a multi-party payments solution?

Your product line is becoming complex and has multiple receiving parties

Splitting multi-party payments manually may improve the payment experience, but doesn’t scale well as you develop your product.

By automating this process, you can continue to build your product pipeline without adding extra complexity or risk to your business.

Your current multi-payment process is becoming too much of a burden

Staying on top of your transaction volume as you grow your business can overwhelm even the most veteran reconciliation and support teams. These departments have limited resources and, faced with the pressure of executing and reconciling an increasing number of multi-party transactions, fatigue and costly errors are bound to occur.

Automating this process helps to streamline your back-office, enabling them to stay on top of transactions while also improving your customer experience.

You’re ready to iterate your current, basic payment infrastructure into something more advanced

Depending on who you work with, you can build a more advanced payment model to improve your customer experience. For example, you could deploy a wallet structure to give each recipient of a multi-party payment a dedicated account to store their share of the proceeds. That, in turn, makes reconciliation for all parties drastically easier.

In any case, multi-party payment solutions make bringing onboard these features efficient and scalable.

3 questions to discover if multi-party payments are right for your business

Still having trouble figuring out if multi-party payments are for your business? Ask yourself these questions to help you find the right answer.

1. Are we managing multiple payment stakeholders as part of our value proposition or future product plans?

If your clients accept payments from their customers and need to spread them to multiple recipients as part of your value proposition, then automated multi-party payments could be the right fit for you.

2. Are we reconciling these payments correctly and efficiently?

If your back-office and tech support teams are struggling to keep up with growing, complex payment volumes, you’ve likely heard about it. Automating this process can go a long way in improving the efficiency of these important teams at the core of your operations.

3. Are we making a lot of push payments?

Pushing multi-party payments manually requires a lot of planning and follow-up. If your teams are doing these regularly, an automated solution could help speed up and remove many of the risks in this process.

The top use cases of automated multi-party payments

Automated multi-party payments can transform industries of all kinds. Here are some of the most popular ones we’ve seen so far:

Online marketplaces

Marketplaces do more than intermediate between buyers and sellers. They need to deliver a comprehensive customer experience to both parties. When a customer makes a purchase from a vendor, that money will generally need to be split between multiple parties.

These could include:

-

A courier or logistics company to deliver the goods (if a physical transaction).

-

An insurer who offers purchase protection or a warranty.

-

The platform for the commissions.

-

The vendor, for their net payment.

If the marketplace operates internationally, there’s a good chance that logistics companies and even insurers will change based on the geographies of both buyer and seller. Sometimes, a customer might not want to add ancillary products like insurance.

For that, dynamic customer functionality can make automated multi-party payments on a marketplace easier to use.

Gig economy platforms

Gig economy platforms connect service and goods providers with consumers who need immediate services or products. In this model, payins from consumers need to go to multiple parties. For example, a food delivery platform would need to take a customer’s order payment and:

-

Pay the restaurant that prepares the meal.

-

Credit the delivery driver with their fee.

-

Reserve a tip that the customer can set at the time of order if they choose to give one.

-

Take their commission for brokering the transaction.

If the gig platform connects consumers with service providers to complete tasks, then payment can also sit in a wallet structure until both parties are satisfied with the work.

Proptech

Property management platforms help landlords and real estate developers better manage their cash flows with payment technology. It’s common to see these tools used not only to help collect rent but also disburse payments for multiple costs, including:

-

Property management fees.

-

Common repairs and building funds.

-

Landlord’s income payment.

By automating these multi-party payments, each beneficiary in this chain gets paid faster and with fewer reconciliation problems involved.

Related reading: Intelligent payment routing: How it works and top use cases

Automate your multi-party payments with Zai

How you choose to manage multi-party payments will go a long way in lowering your costs, improving your customer experience, and winning new customers.

At Zai, we have a proven track record of helping companies with complex payment needs bring their infrastructure to new levels with multi-party payments. Contact us today to find out how we can transform the way your company handles payments.

This information has been updated and is correct as of March 2023. This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment. This article is purely for general information purposes.