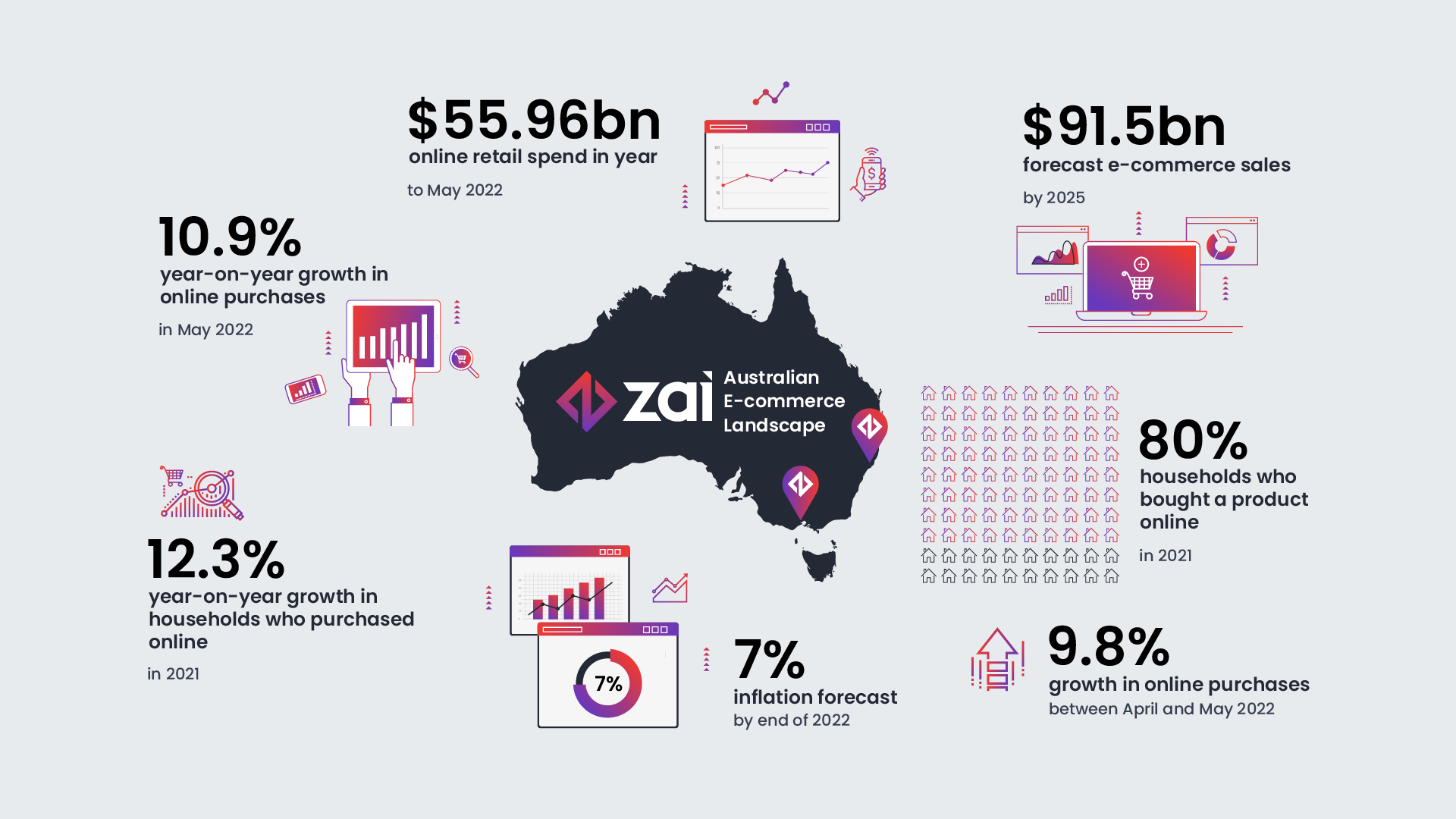

The titans of online marketplaces and platforms are those that add the most value, build the most trust and create frictionless experiences. Payments are a major component of each.

It’s undisputed there’s a revolution taking place in online payments. Considering how many transactions are still happening offline though, we’ve still got a ways to go before we’ve completely optimized the way people transact.

That said, prior to integrating payments into your online marketplace or platform you should first consider the following questions:

- How much can you charge?

- How much will it cost to provide & maintain a payments service?

In this article we’re going to provide you with some solid advice on how to assess both of these questions. More importantly, we’ll look at how you can ensure you’re maximizing your margins or remaining cost neutral while still providing value-added services.

Let’s begin.

Nail down the specific reason for a payments integration

Be absolutely clear on why you’re integrating a payments system. Are you integrating payments because you want to bring in extra revenue? Or, is it to remain competitive and protect your market share? It’s likely a combination of both.

1) How much can you charge?

The simplest way to answer this question is to see what your competitors are charging. If you don’t have direct competitors yet, what are similar businesses charging?

Secondly, you need to consider whether you represent a “marketplace” or a “platform” because this largely affects what you can charge.

Payment integrations for marketplaces

If you represent a marketplace, this means you connect buyers and sellers and transactions can’t happen without your service. If this is the case, obviously you can charge considerably more.

Generally we see marketplaces charging 5% to 30% with most above 10%.

It’s important to consider who needs your service more and who benefits most in getting paid expediently, the customer or the service provider? Generally it’s the service provider and this is who you should charge the larger portion of your fees to.

- Consider charging buyers (customers) a fee for their payment choice. Such as charging 2.9% for a credit card but providing ACH or Direct Debit for 1%, with free wire transfers.

- Then charge service providers 5-30% based on what your competitors or similar marketplaces charge.

Also since you’re essentially providing the customer to the service provider, look at what your service provider’s Customer Acquisition Costs (CAC) are. This includes obtaining leads, negotiating and quoting.

Finally, look at the time your customers spend creating invoices and chasing payments. If you provide efficiency in this area then you can obviously charge considerably higher fees.

Payment integrations for platforms

Platforms generally don’t connect two parties. Instead, they provide one-sided relationships usually with service providers so it’s difficult to charge higher fees.

Why?

- Because a platform’s fees will inevitably be compared with payment processing fees from major payments service providers.

- Things like Customer Support and Fraud Protection or Insurance generally aren’t needed so transaction costs are significantly lower.

If your business falls into a platform category we recommend charging a fee of 0.2-2% on top of the payment processing fees.

Again, this primarily falls into what your competitors are charging. If you happen to be the first in your industry do this obviously you should be looking to charge more while planning to decrease costs over time as your competition catches up.

How much will it cost to provide & maintain a payments service?

Everything comes down to how much you’re going to do yourself vs. how much you’re going to lean on a third party. Consider the cost of design, integration and marketing the new service.

We put a big emphasis on communications and marketing and highly recommend spending more on these than the design and integration of the service. Also if you don’t have in-house fraud, risk and payments personnel you must factor in the cost of hiring these people vs. using a service to do these tasks for you.

The overall costs for marketplaces

Trust is a critical component of any marketplace where transactions can go wrong. A quality marketplace must be there to assist in resolving issues and protect both parties against loss. With every transaction the marketplace brand is at risk so payment processing isn’t the most important thing.

Customer Service, user verification and fraud insurance are where your focus should be.

- Looking at fraud, generally 1% of all online transactions end in chargeback.

- Around 0.3-0.5% of all chargebacks are lost depending on your country.

- For marketplaces, this is closer to 3% (Zai currently sits at 0.003%) on average as you need to know both buyers and service providers.

A marketplace is also at risk from crime rings hitting their service attempting to run stolen cards through the system. It’s important to note 90% of the fraud out there happens to the weakest 10%! So if you don’t have a dedicated and experienced Fraud or Risk Team we strongly recommend outsourcing this.

For Customer Support, think about whether you have a specialized support team to deal with disputes, refunds and chasing down payment requests. If not, how much will it cost you to hire or train your existing team?

Consider passing the transaction cost on to the person choosing to use the payment type which is generally is the buyer. Include other costs such as customer support, tech, fraud and risk support into your marketplace fee.

The overall costs for platforms

Generally we see platforms integrate payments because they want to remain competitive and protect their existing revenue streams. As previously noted, the margin a platform can charge is considerably less than a marketplace.

However, a platform shouldn’t need fraud protection/insurance or payments-related customer service either because the platform hasn’t introduced the two parties and the buyer probably doesn’t even know the service provider is using the platform.

For platforms it’s about keeping costs to a minimum with slim margins in return for adding value to one of the parties and covering the costs of doing so. It’s imperative a platform charges even a small fee for providing payments if just to cover their costs of maintaining the service.

Generally 0.2% covers the costs of providing these types of services so anything above this is fine.

Conclusion: Successfully run payments with deliberate strategy

Right, so that was a bit to swallow there but we ironed out the differences between marketplaces and platforms so you should know which category you’re in. You should also have a better understand of how many factors fit in.

Take a step back, get down to the nitty-gritty and approach running a payments service strategically to get your margins where they need to be for growth as well as customer satisfaction.