It can often be hard to see and understand the use cases for Open Banking. However, there is one use case where Open Banking payments are a no-brainer: money transfer services.

If your company requires customers to send high value payments regularly, an Open Banking setup can help improve the payment flow, decrease customer support calls and improve auto-clearing rates. This is especially true if customers are currently having to make a manual push payment from their bank account to make their transfer.

In this article we’re going to explain:

-

How 56% of CurrencyFair transfers are conducted via Open Banking and auto-clearing is at 80%.

-

The results: happier customers and a higher auto-clearing rate.

Note: are you a money service company looking for support in setting up payment flows? Reach out to us to learn more about how we can help you at Zai.

Why Open Banking works so well for money transfer services

If you offer money transfer services, you probably face the following issues:

-

Low auto-clearing rates, as customers often get the payment reference number wrong.

-

Resources spent on human support to respond to customers demanding where their payment is, and on finding and reconciling each payment.

-

A complex payment workflow which results in drop-offs and incomplete payments.

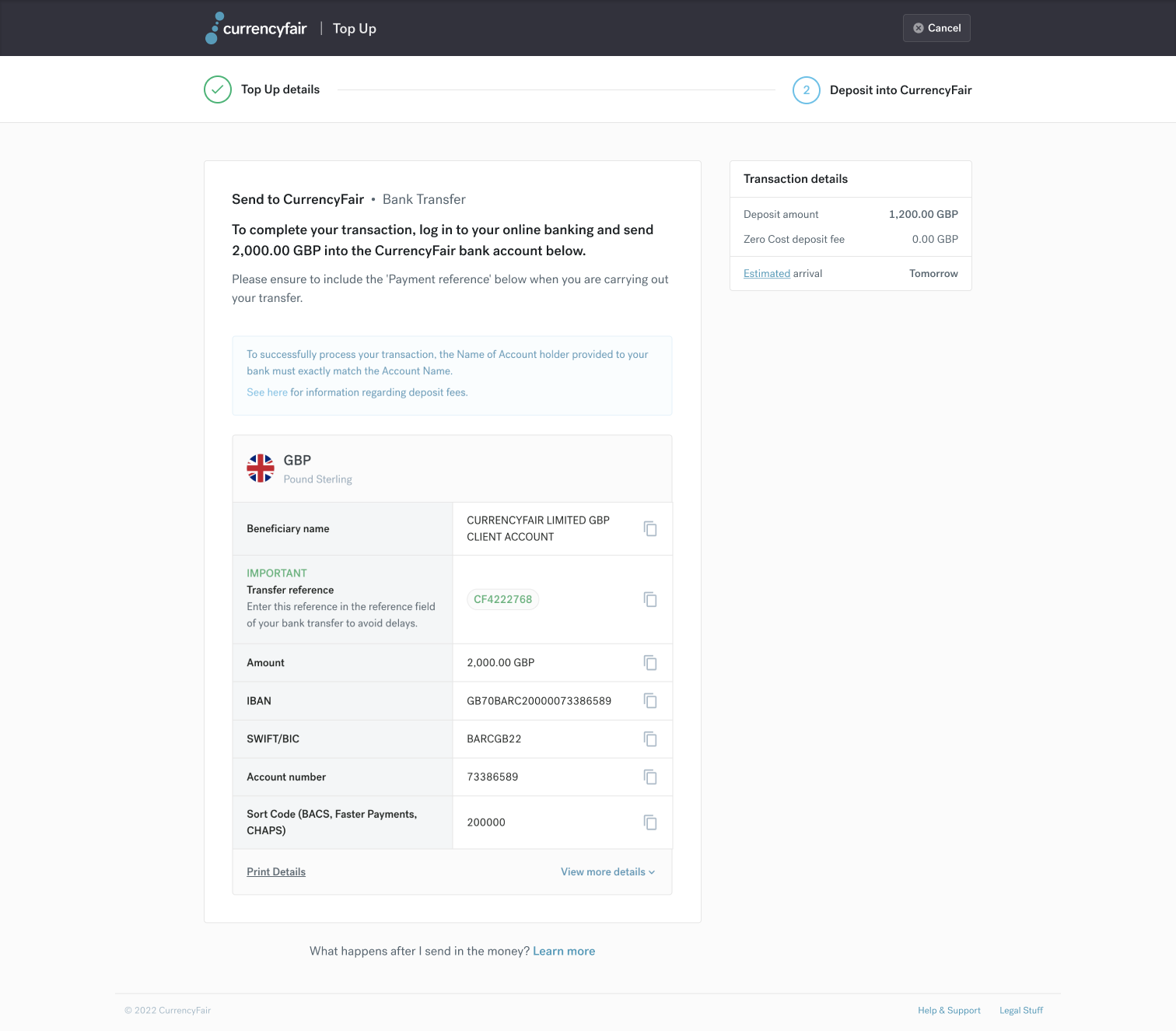

The usual deposit method screen approach is what has been used in the industry for decades, and has worked well in the past. But it causes the issues mentioned above.

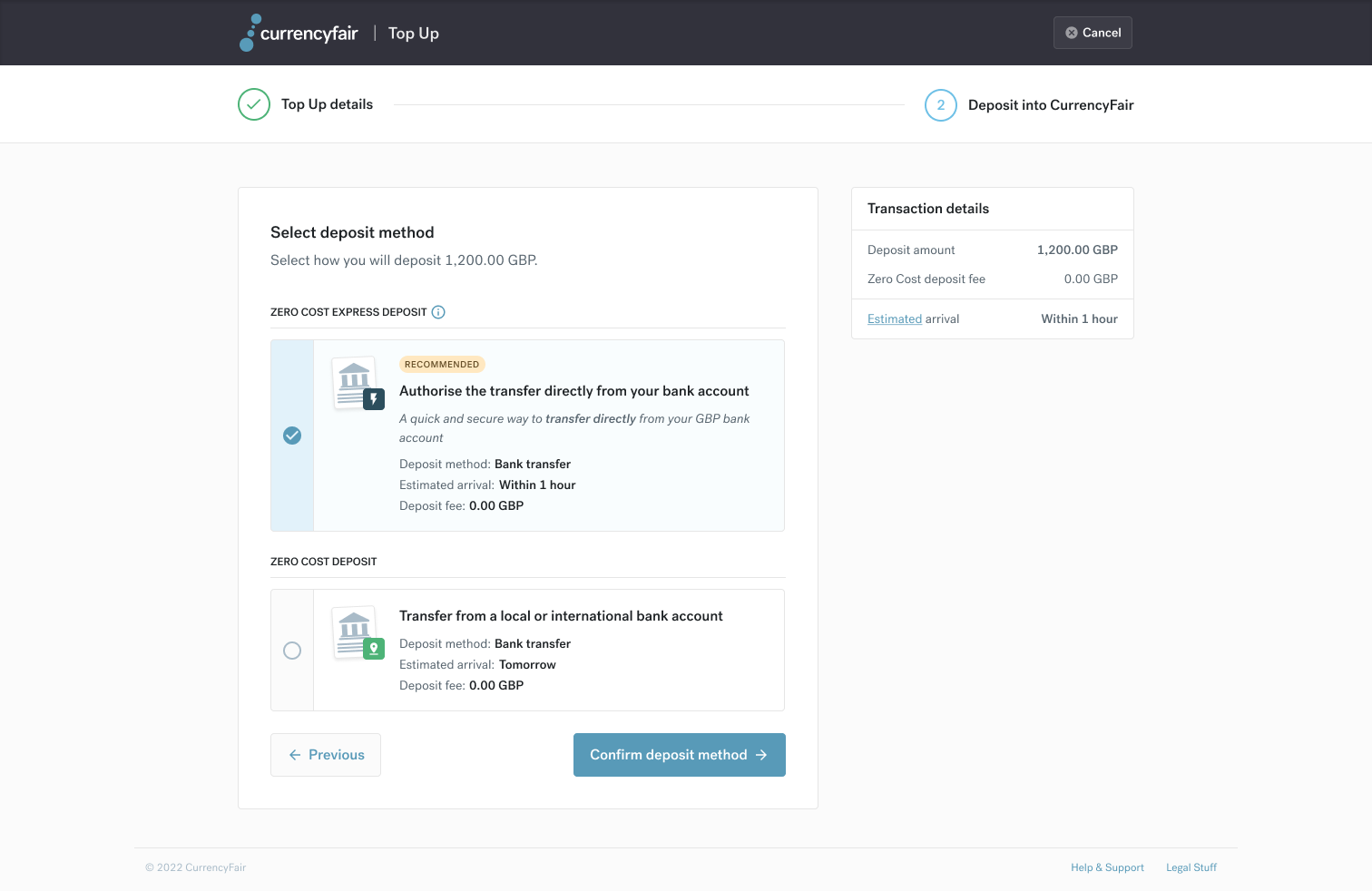

With Open Banking, the entire process is redesigned.

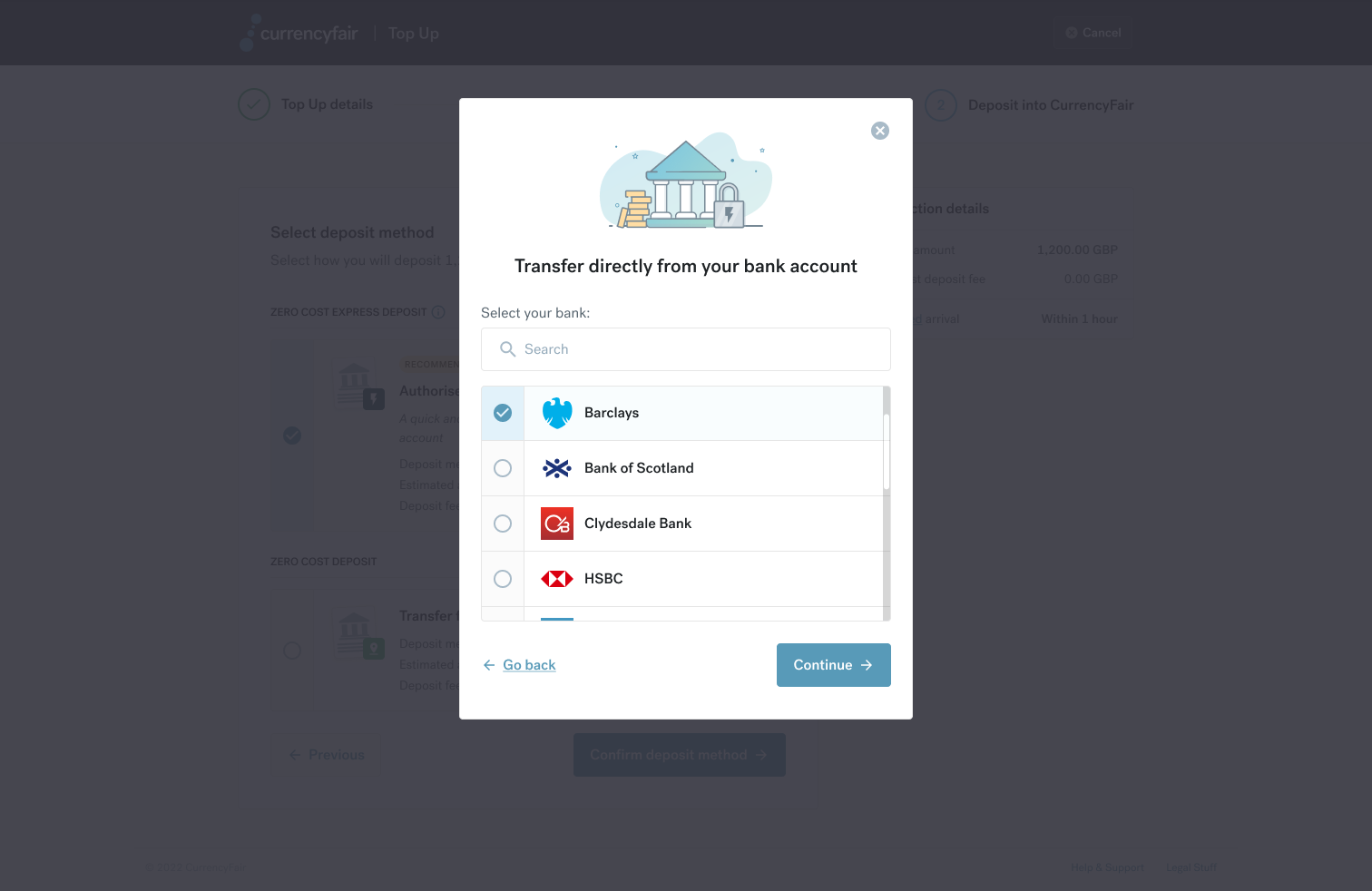

Instead, when a customer wants to make a payment, they're automatically connected to their bank via a third-party Open Banking provider. They pick their bank from a selection, and then are asked to log in and approve the payment. Once approved, the payment goes through automatically.

With Open Banking, payments are just as fast and cheap as bank transfers, but the flow is a lot easier and more user-friendly. What used to require a separate login, along with manually inputting bank details and a reference number, now happens all in one flow.

But it’s hard to illustrate and explain the impact of an Open Banking experience without a real-life example and screenshots of the user experience.

Zai’s sister company CurrencyFair has seen its Open Banking volume rise to 56% of transactions. Here’s how they did it.

How 56% of CurrencyFair transfers are now completed via Open Banking

CurrencyFair is a peer-to-peer currency exchange marketplace that allows users from multiple countries around the world to send money at better exchange rates.

Before, CurrencyFair customers made a payment similar to other money transfer services: once they reached their deposit method screen, then they have to head to their bank account and make a manual bank transfer.

The reason CurrencyFair decided to set up Open Banking payments was simple: it made sense for customers and for the business. The improved payment flow would increase customer satisfaction, and fewer errors would help decrease customer support costs.

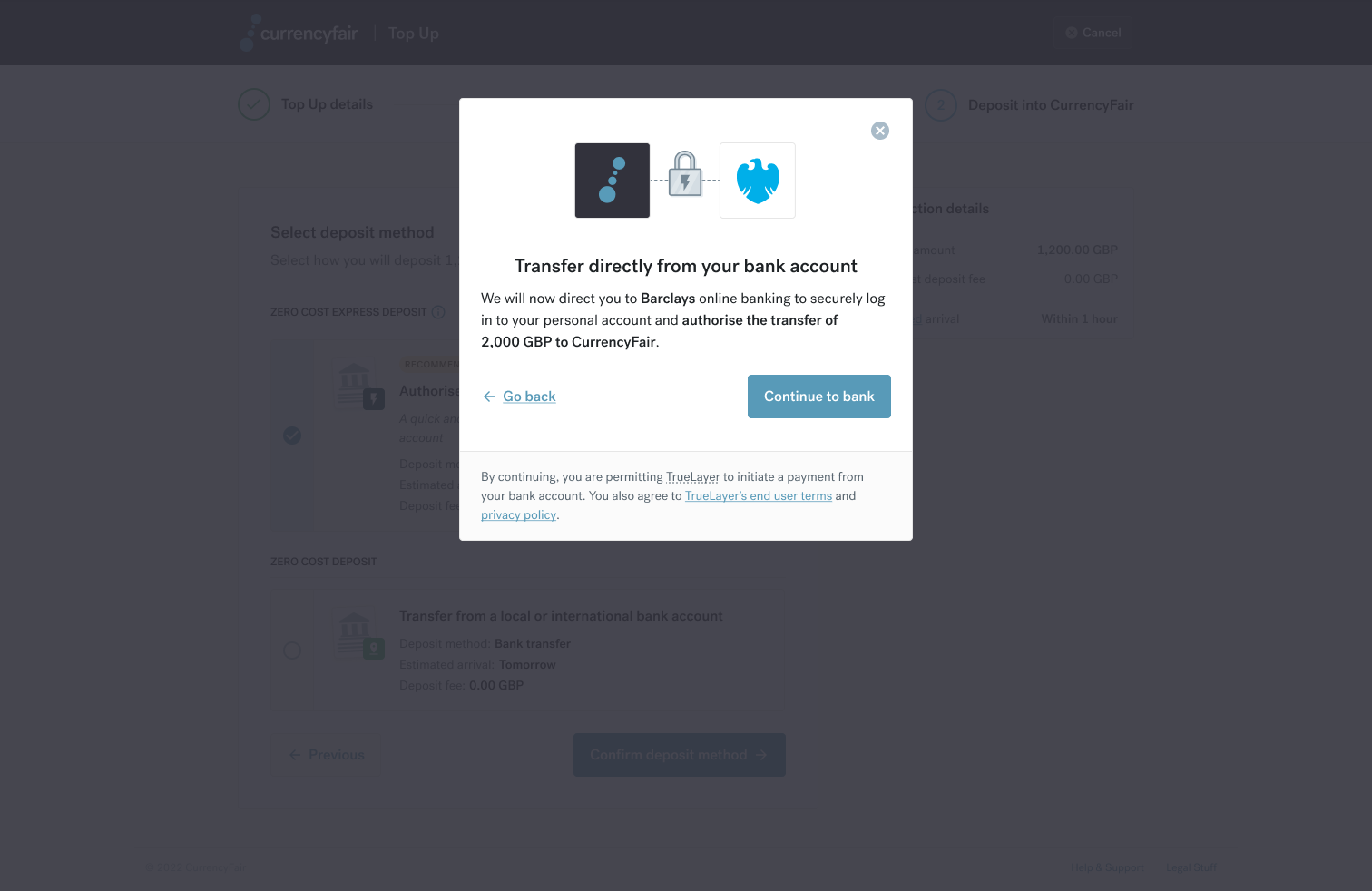

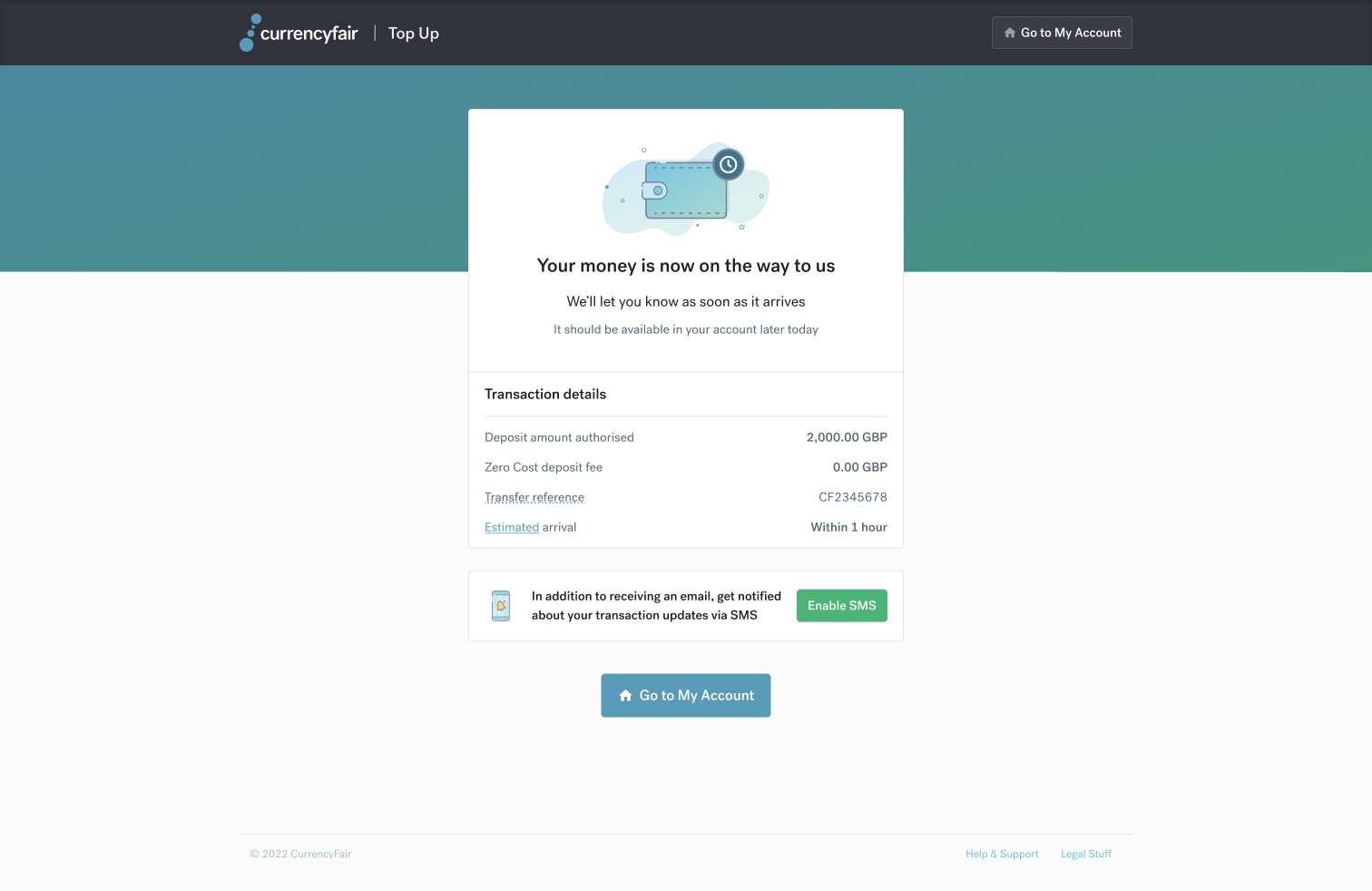

After six months of hard work, the CurrencyFair product team set up Open Banking by partnering with Truelayer and redesigned the flow. The payment flow now looks like this:

The results: happier customers and a higher auto-clearing rate

For the customer, that means:

-

Transfers are faster (they don’t have to log into their bank account and input bank details).

-

The payment flow is a lot easier to complete and intuitive.

-

They don’t have to worry about inputting a customer reference number.

-

They don’t have to worry about their payment getting lost.

And for CurrencyFair, the benefits are:

-

An auto-clearing rate of 70 to 80% (which could be optimised even further).

-

A decrease in customer support calls.

-

Fewer errors that require human support to rectify them.

Most of all, the fact that 56% of transfers now take place through Open Banking means that people find it useful and prefer it to other payment methods.

Tips for companies implementing Open Banking

Many companies and transfer companies might hesitate to implement Open Banking for a few reasons:

-

The required time and resources investment to set up Open Banking is high.

-

They might be worried they wouldn’t be able to influence consumer behaviour enough for there to be high uptake.

-

They are concerned that it’ll decrease trust.

These were the same concerns CurrencyFair had at the beginning. But after demo day and understanding the benefits to customers, the pros far outweighed the cons. And as demonstrated by the results, they could positively influence customer behaviour and overcome trust issues.

However, there are still some things to keep in mind to ensure you make the most of Open Banking as a payment method:

Don’t underestimate the importance of educating the user

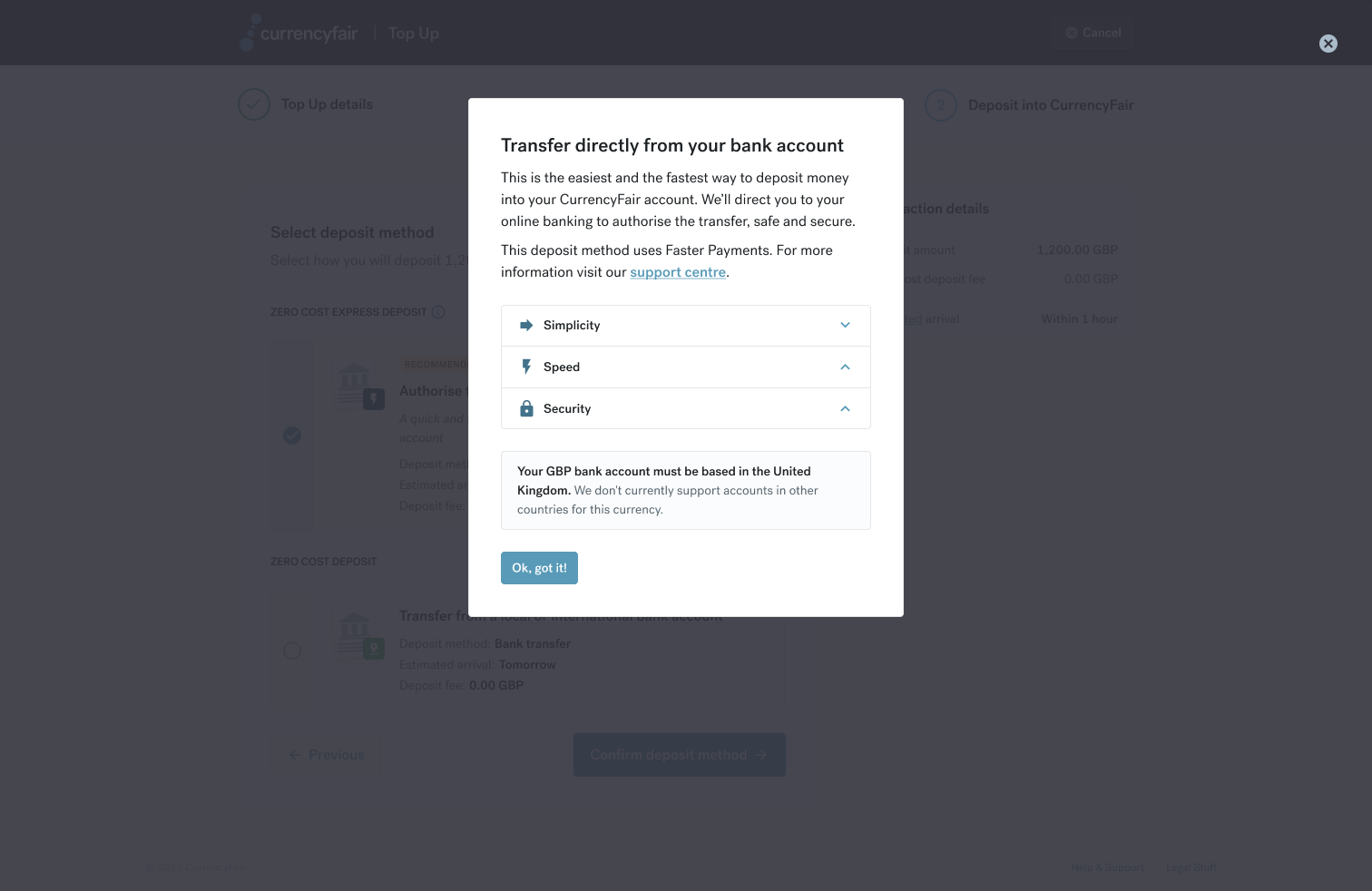

One of the key mistakes companies make when implementing Open Banking is not focusing enough on the trust aspect. Since this is a new payment method, it’s incredibly important that the customer understands and is informed on how it works.

That’s why it’s better to overexplain and make sure the language is clear.

CurrencyFair approached this in a few ways:

-

Making sure there are multiple sections that educate the customer on what this payment method is and why it's guaranteed and safe.

-

Make sure the copy is clear. Truelayer’s guidelines on this are helpful.

In the educational drop down, CurrencyFair included information about:

Security: this section explained that the transfer was guaranteed by the FCA.

Speed: this section explained why this payment method is faster and why it saves time.

Simplicity: this section explained why the transfer was simpler than a manual bank transfer.

.png?width=1512&name=Open%20Banking%20modal%20_%20Info%20(details).png)

Don’t use the term Open Banking

Open Banking is an industry term and can be confusing to the customer. Open Banking also includes many other things than just payments, so it’s not even really adequate to use the term.

Before choosing a term, it’s a good idea to test the copy on different users and measure uptake. Your Open Banking provider should also offer some recommendations on the words to use.

Do a demo day

It can be hard to understand how Open Banking works and why it’s so transformative with just words and ideas. The best way to communicate its value is to set up Open Banking transfers in a test environment and then demonstrate the flow to the whole team.

Once you see it in action, it’s hard to not see the value in implementing Open Banking payments.

In general, Open Banking payments seem to be a great use case for frequent high value payments, where the flow is currently disruptive or highly expensive. It could be for a money transfer service which currently requires customers to do a bank transfer from their bank. Or it could also be a crypto platform that accepts high value deposits via cards, which can be expensive.

With Open Banking, payments are as cheap and fast as bank transfers, and the flow is a lot more intuitive.

Interested in learning more about Open Banking? Get in touch with us and we’ll see how we can help you.