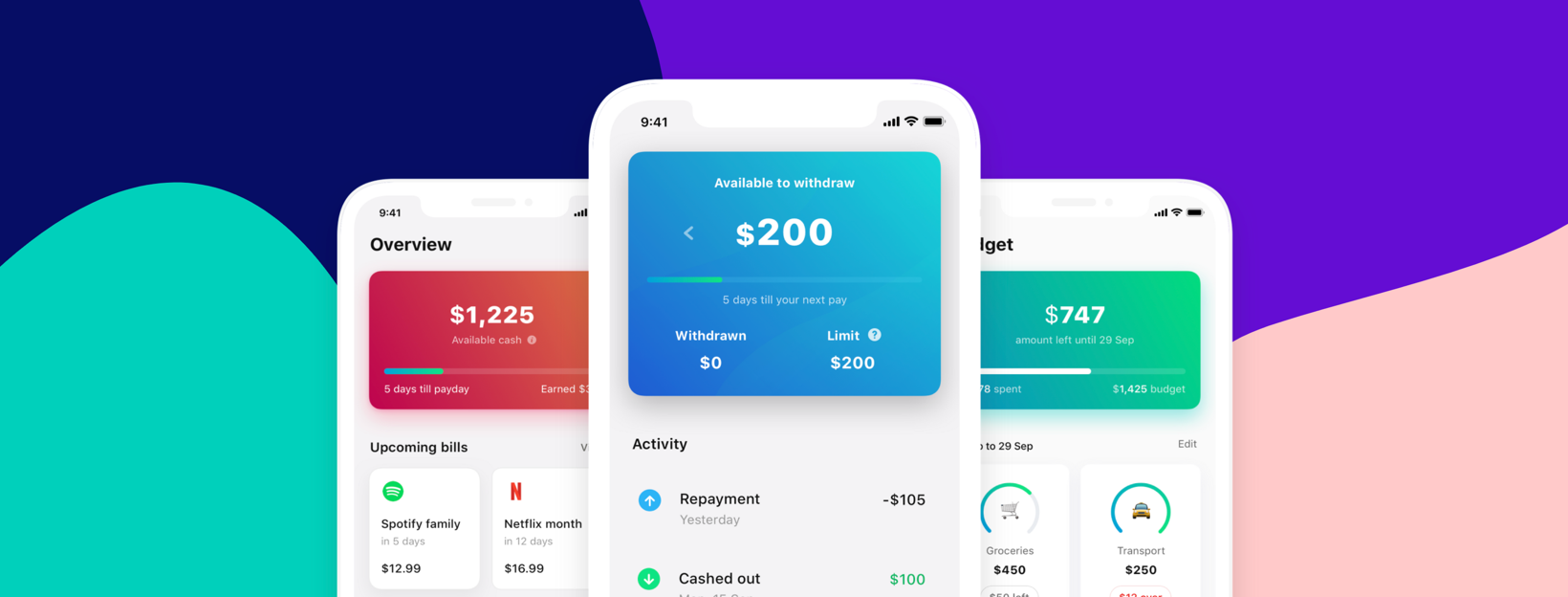

Beforepay's Pay on Demand™ app gives customers early access to their wages and by leveraging machine learning, AI and statistical analysis equips them with a financial management tool that they can use to manage their expenses and monthly budgets.

The challenge

Enhancing customer value by launching a unique product to the market

The outcome

Beforepay has reinvented the way salaried workers receive their accrued wages, with access within 60 seconds, achieving a 4.9 star rating on the Apple App Store.

Beforepay's Pay on Demand™ app gives customers early access to their wages and by leveraging machine learning, AI and statistical analysis equips them with a financial management tool that they can use to manage their expenses and monthly budgets.

Funds are repaid when wages are received, which creates additional customer benefits by helping them avoid skyrocketing interest rates on small loans. Since working with Assembly (now Zai), Beforepay has experienced some positive wins for the business:

- Reduce the time of deposit clearance from 48 hours to 60 seconds

- More than 200,000 users

- Achieved 4.9 rating and Top 10 on the Apple App Store

"Although complex to implement, this core value could differentiate us, giving us a unique selling point and a competitive advantage. After looking around the industry, we felt that Zai had the most mature and reliable real-time payments platform in the market."

About Beforepay

It’s with good reason that Beforepay's positioning statement promises customers that they will “get paid on-demand”. By using technology to meet today’s concept of avid consumption, the company has led the way in revolutionising how customers access emergency cash ahead of payday.

The company's Pay on Demand™ app gives customers early access to their wages and by leveraging machine learning, AI and statistical analysis equips them with a financial management tool that they can use to manage their expenses and monthly budgets. Funds are repaid when wages are received which creates additional customer benefits by helping them avoid skyrocketing interest rates on small loans.

A winning customer value proposition

“When we founded the company, our priority was to close the payday gap faced by salaried employees and provide customers with instant wage deposits into their bank account. Although complex to implement, this core value could differentiate us, giving us a unique selling point and a competitive advantage. After looking around the industry, we felt that Zai had the most mature and reliable real-time payments platform in the market,” says Dean Mao, co-founder and Chief Technology Officer at Beforepay.

The founding team wanted to launch Beforepay complete with instant payments in order to meet the brand's core promise to its customers.

For many salaried employees, the lack of funds usually occurs two to three days before their payday. If Beforepay had launched their product without real-time payments, users would only get their pay in 48 hours.

"To help customers meet their shortfall, we knew that instant payments were necessary."

A customer value proposition that delivers on brand promise

To help the fintech realise their vision, Zai worked with Beforepay to help them connect to real-time payment rails.

As a result, Beforepay's customers could transfer their paycheck to their bank account, gaining access to their pay within 60 seconds for unforeseen expenses such as home repairs and other bill payments.

“The team from Zai took the time to understand our core value proposition, and they were able to create an implementation plan that enabled us to go to market rapidly while also delivering specific value for our customer. Zai documentation and integration process was straightforward, and we received support every step of the way. Our favourite feature is the ability to provide customers instant payments any time, any day, 24/7. The API web hook feature also complements the payment life cycle to track the payment status giving our customer certainty that the payment is on its way,” concludes Mao.

User growth - The benefit of an enhanced core value proposition

Once integrated into Zai payment platform, API automation helped the Beforepay team move away from repetitive work such as manual reconciliation. This enabled them to concentrate on improving their product, which led to a 4.9 star rating on the Apple App Store, and gaining Top 10 position on the app store’s charts.

The team at BeforePay noticed that payday loans are becoming increasingly prevalent, and with high interest fees, they might not be the cheapest solution to solving their payday gap. This is why Beforepay believe they stand out as a strong alternative.

With Beforepay’s Pay on Demand™ solution, salaried employees are able to receive a portion of their paycheck before their payday with no interest and only a small transaction fee.

As a result, the company has grown in popularity, with over 200,000 new users joining their platform in the last couple of months and secured a 4.9 rating on the Apple App Store.